![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

In trading, a sideways market is considered a golden opportunity for you to make money on short trades. Today, I will show you how to apply the RSI indicator combined with Bollinger Bands to produce picturesque entry points in IQ Option. I will prove that this combination is simple but extremely effective. Let’s read!

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Low volatility market is the time to make a profit in IQ Option

The sideways market is an opportunity for you to trade with short orders. Traders will act quickly as soon as they see market hesitation on the candlestick chart.

How to use the Bollinger Bands indicator in a sideways market

The Bollinger Bands indicator works well when used in low volatility markets. It helps you to quickly recognize the entry signal when the price closes outside the upper or lower band.

How to use the RSI indicator in a sideways market

The Relative Strength Index (RSI) is an index of relative strength, used to measure the speed and change of price movements. RSI fluctuates in a range from 0 to 100, reaching oversold when above 70 and reaching overbought when below 30. You can catch an exact reversal point when the price is in either of these two states.

How to trade when combining Bollinger Bands and RSI indicators in IQ Option

The Bollinger Bands and RSI indicators both have their own disadvantages. However, when combining them together, the transaction signals become accurate. I will guide you in more detail through the opened orders below.

Open a HIGHER order when: the candlestick closes out of the lower band and the RSI points up from below the 30 level.

Open a LOWER order when: the candlestick closes out of the upper band and the RSI heads down from above the 70 level.

Review how to trade with Bollinger Bands and RSI indicators

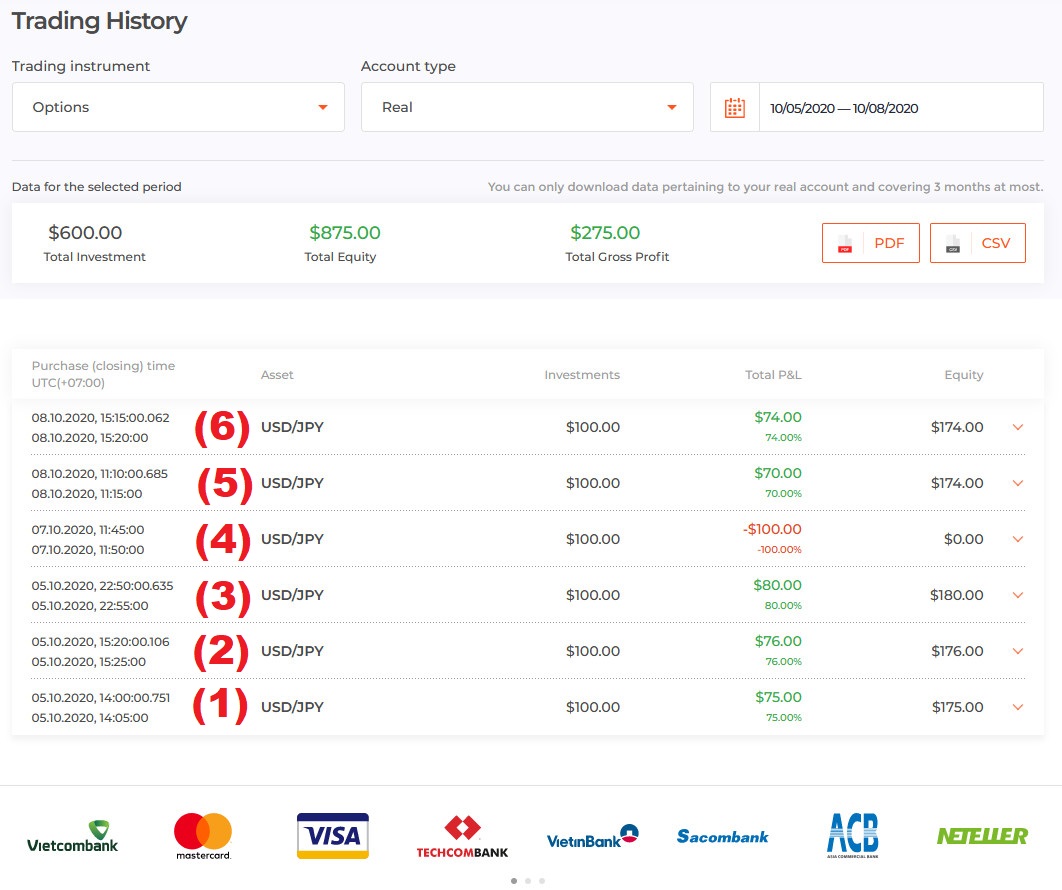

Conditions: A 5-minute Japanese candlestick chart. Set up the Bollinger Bands and RSI indicators as default.

Currency pairs: USD/JPY.

1st order: On October 5, with the USD/JPY pair, a candle closed out of the upper band when the RSI was pointing down from above the 70 level. Opened a LOWER order with an expiration time of 5 minutes for $100 => I won.

2nd order: With the same USD/JPY pair on October 5, a candle appeared to close out of the upper band. Right there, the RSI headed down from above the 70 level signaling overbought. Opened a LOWER order with an expiration time of 5 minutes => I won.

3rd order: On October 5, with the USD/JPY pair, a long green candlestick closed out of the upper band while the RSI was pointing down from above the 70 level. Opened a LOWER order with an expiration time of 5 minutes => I won.

4th order: On October 7, with the USD/JPY pair, a candlestick closed 100% out of the upper band when the RSI was above the 70 level. Opened a LOWER order with an expiration time of 5 minutes => I lost.

5th order: On October 8, with the USD/JPY pair, a candlestick that closed 100% out of the upper band appeared. The RSI indicator showed that the price was overbought when it headed down from above the 70 level. Placed a LOWER order with an expiration time of 5 minutes => I won.

6th order: On October 8, with the USD/JPY pair, a candle closed out of the lower band. Right there, the RSI pointed up from above the 30 level. Placed a HIGHER order with an expiration time of 5 minutes => I won.

In conclusion

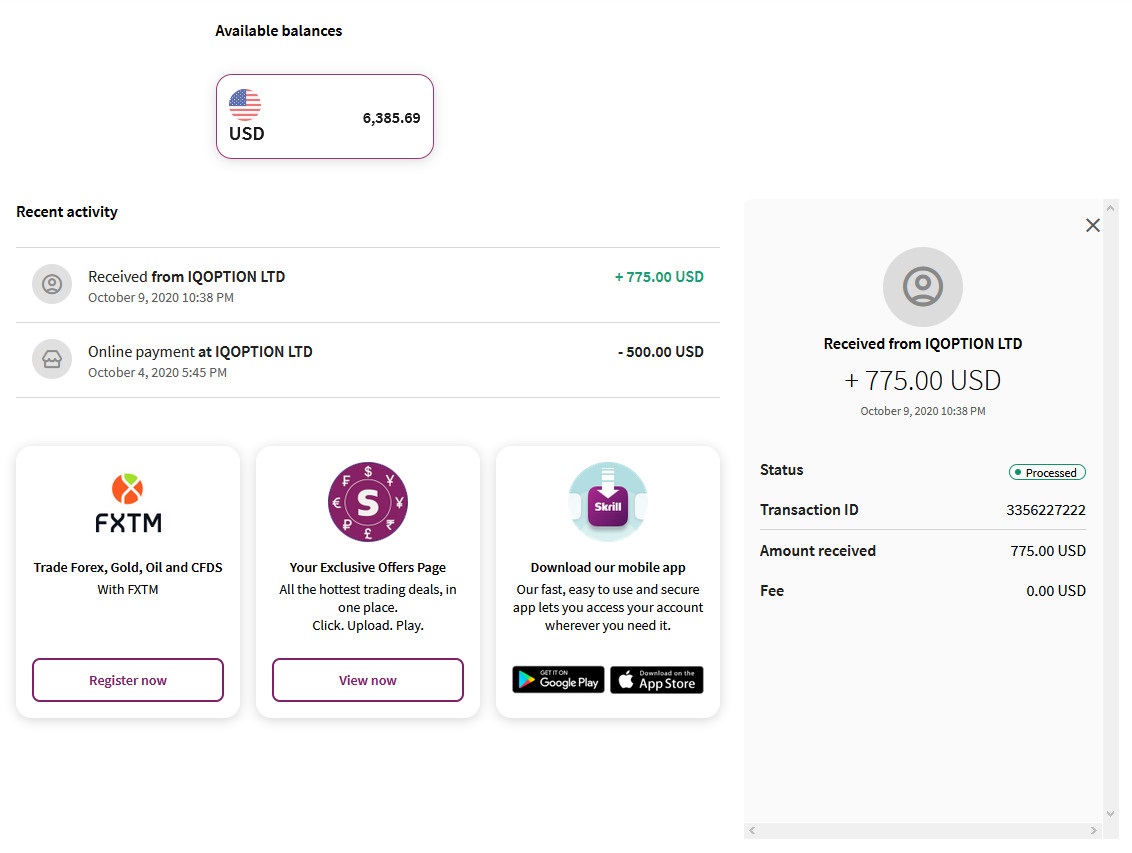

If you already have a trading strategy with a high win rate, then what are you waiting for without practicing it on a demo account? No matter how good a strategy is, it is meaningless if you skip the practice step. If you want to make money in IQ Option, you need to learn and practice at the same time. I wish you successful transactions.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu