![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

To become a successful trader in the financial market you must have a unique characteristic. That is, in IQ Option trading, you must have an effective strategy of your own to bring about profits. In this article, I would like to share with you the T.L.S trading strategy which is drawn from my own trading process in IQ Option.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

The T.L.S trading strategy

A simplified trading style is what I always aim for. No need for technical analysis indicators, I just use the most basic things on the chart. They are trends, resistance/support, candles or high-precision candle patterns.

(i) Trend

Trends are the first thing you should master. Because basically, all online transactions in IQ Option are entered when a bullish or bearish trend is happening.

The uptrend is when you connect peaks and troughs together. The previous peak and trough are higher than the previous ones.

The downtrend is determined by connecting peaks and bottoms together. The next peak and trough are lower than the previous peak and trough respectively, then the bearish trend is created.

Only trade when you can determine the trend of the market.

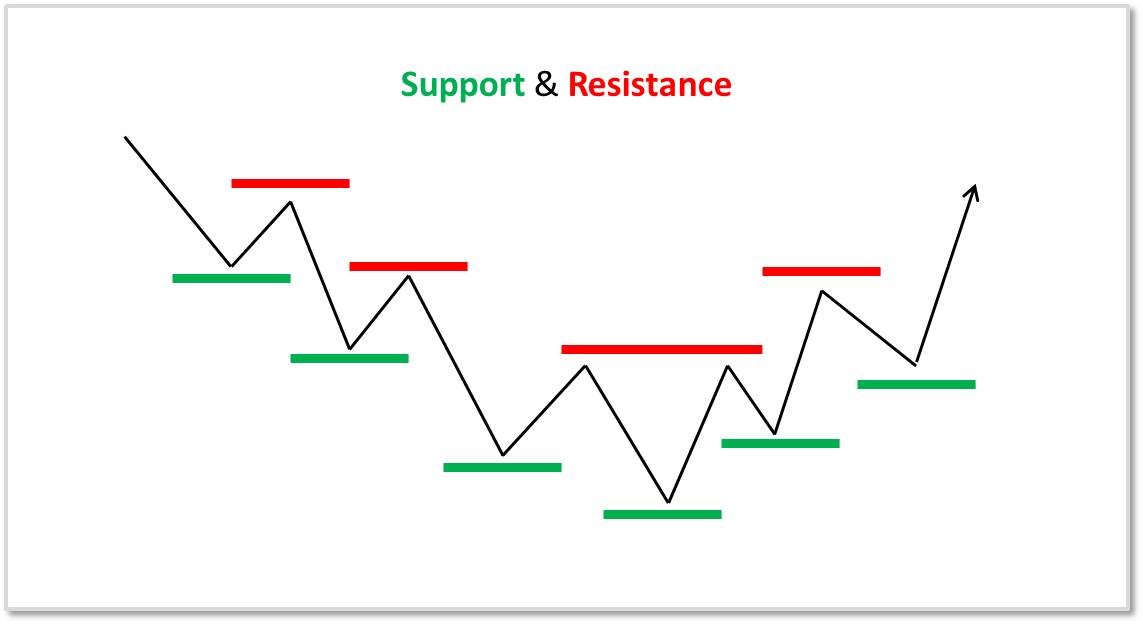

(ii) Levels (Resistance/Support)

Determine what the current market trend is and just follow the trend and open orders in safe resistance/support zones.

Resistance

When the price goes up and then declines, the highest level reached before the price continues its uptrend is called the resistance zone.

This is the price zone that investors expect it to decrease. Here, the sellers prevail over the buyers. Most investors will sell when the price enters the resistance zone.

Support

When the price falls and then rises again, the lowest level reached before the price rises again is called the support zone.

This is the price zone that investors expect it to increase. At that price level, the buyers are prevailing over the sellers.

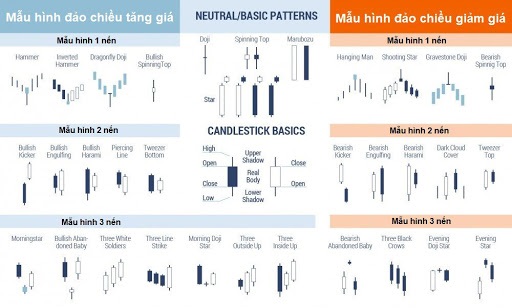

(iii) Signal

These are special candles or high-precision candle patterns when combined with the trend right at the Resistance/Support zones.

Special candlesticks

My favorite candlesticks, because they have high accuracy, are Dragonfly, Pinbar, Pullback, Tombstone, Hangman, etc.

Special candlestick patterns

Strong reversal candlestick patterns trusted by experienced traders include Morning Star, Evening Star, Tweezer, etc.

There are also strong trend continuation patterns such as Three White Soldier, Three Black Crows, etc.

If you meet all of the above 3 conditions, you have had enough basics to open an order in IQ Option.

Capital management

If the trading method is used as an offensive tool, then the risk management will be a defensive one to minimize losses. Because basically, those who do not protect themselves against dangers are always the ones who suffer the most.

Martingale

Double the investment for each order?!? It is too dangerous even in theory or practice. In the market, there are always unbelievable things, and capital management is meant to limit losses. But with the Martingale capital management method, it goes against all the criteria. That’s why I do not apply this method.

Snowball (compound interest)

The Snowball method of capital management is effective only when your trading method has a high win rate of over 85%. According to my statistics, my method of winning rate is only about 70-75%. So I am not confident enough to enter a trade with the Snowball capital management method.

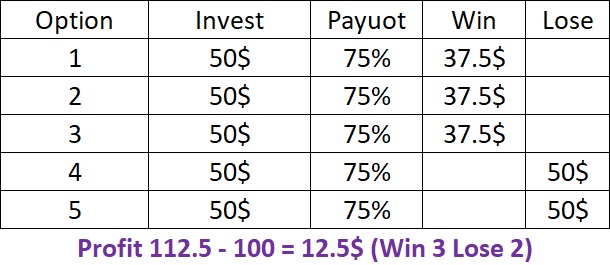

Classic (balanced investment)

This can be considered as the most appropriate capital management method to use with the T.L.S strategy. Because if you balance your investment for each order when the pay-out rate is 80% and the probability of winning is 60%, you can still make some profit. It means that if you win 6 out of 10 orders, you will still be profitable.

Trading psychology and trading principles

– Maximum of 5 orders per day. Each order is $50.

– When losing 3 consecutive orders, stop trading because more or less, your psychology has been affected.

– If you win a sequence of 4 orders, then you should end your trading day.

– Do not trade 30 minutes before and after breaking news release.

– Only open “HIGHER” orders during an uptrend, and “LOWER” orders during a downtrend.

– Do not open many orders at once or consecutively.

– Only trade with the following 3 assets pairs: AUD/USD, USD/JPY, EUR/USD.

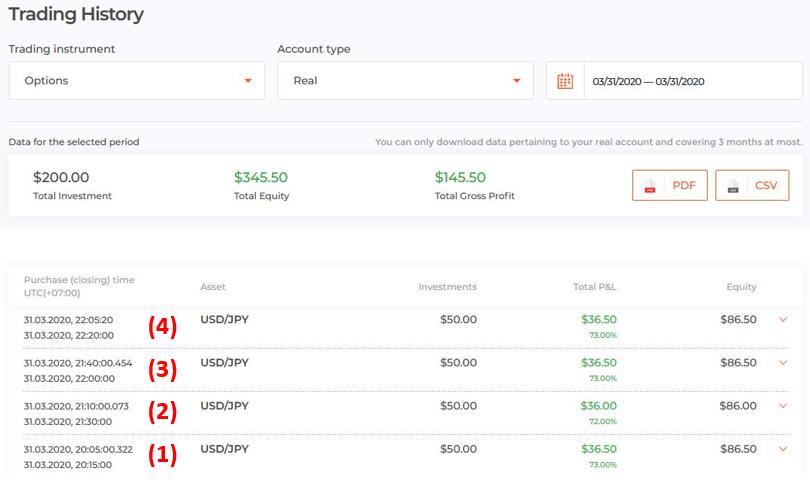

Review on trading orders in IQ Option on March 31, 2020

Entry signal

HIGHER = Bullish trend + support + signal candles.

HIGHER = Bearish trend + resistance + signal candles.

Classic capital management: Open a maximum of 5 orders per day and $50 for each.

Entry points on March 31, 2020, with the T.L.S trading strategy.

Order 1: Bearish trend + resistance + the candle tested the level it just passed = Opened a “LOWER” order.

Order 2: Bearish trend + resistance + Shooting Star candlestick = Opened a “LOWER” order.

Order 3: Bearish trend + resistance + the Doji candle tested the level = Opened a “LOWER” order.

Order 4: Bearish trend + resistance + the candle tested the level = Opened a “LOWER” order.

Because of the principle of 4 consecutive winnings, I had to end my trading day here.

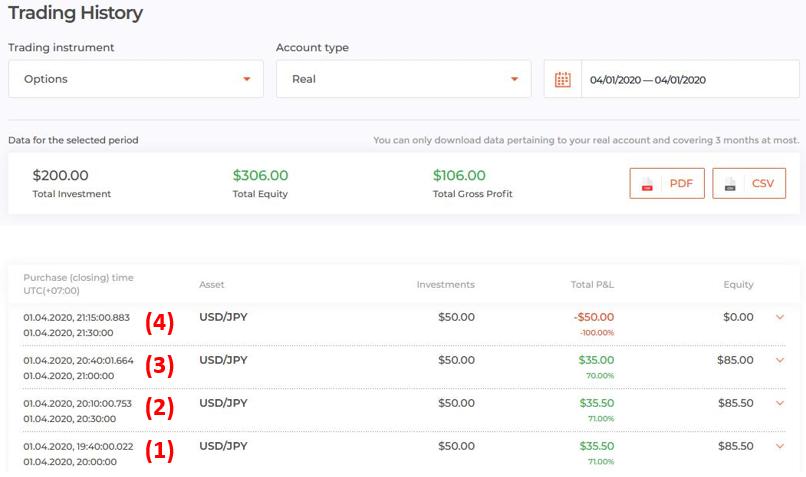

Review on trading orders in IQ Option on April 1, 2020

Entry points on 4/1/2020, with the T.L.S trading strategy.

Order 1: Bearish trend + resistance + Shooting Star candlestick = Opened a “LOWER” order.

Order 2: Bearish trend + resistance + the candle tested the level = Opened a “LOWER” order.

Order 3: Bearish trend + resistance + Shooting Star candlestick = Opened a “LOWER” order.

Order 4: Bearish trend + resistance + Shooting Star candlestick (the price tried to reversed but failed) = Opened a “LOWER” order.

At this point, the downward trend started to weaken and the buyers joined in, making the price war balanced. The trend was mostly sideways so I chose to stay out.

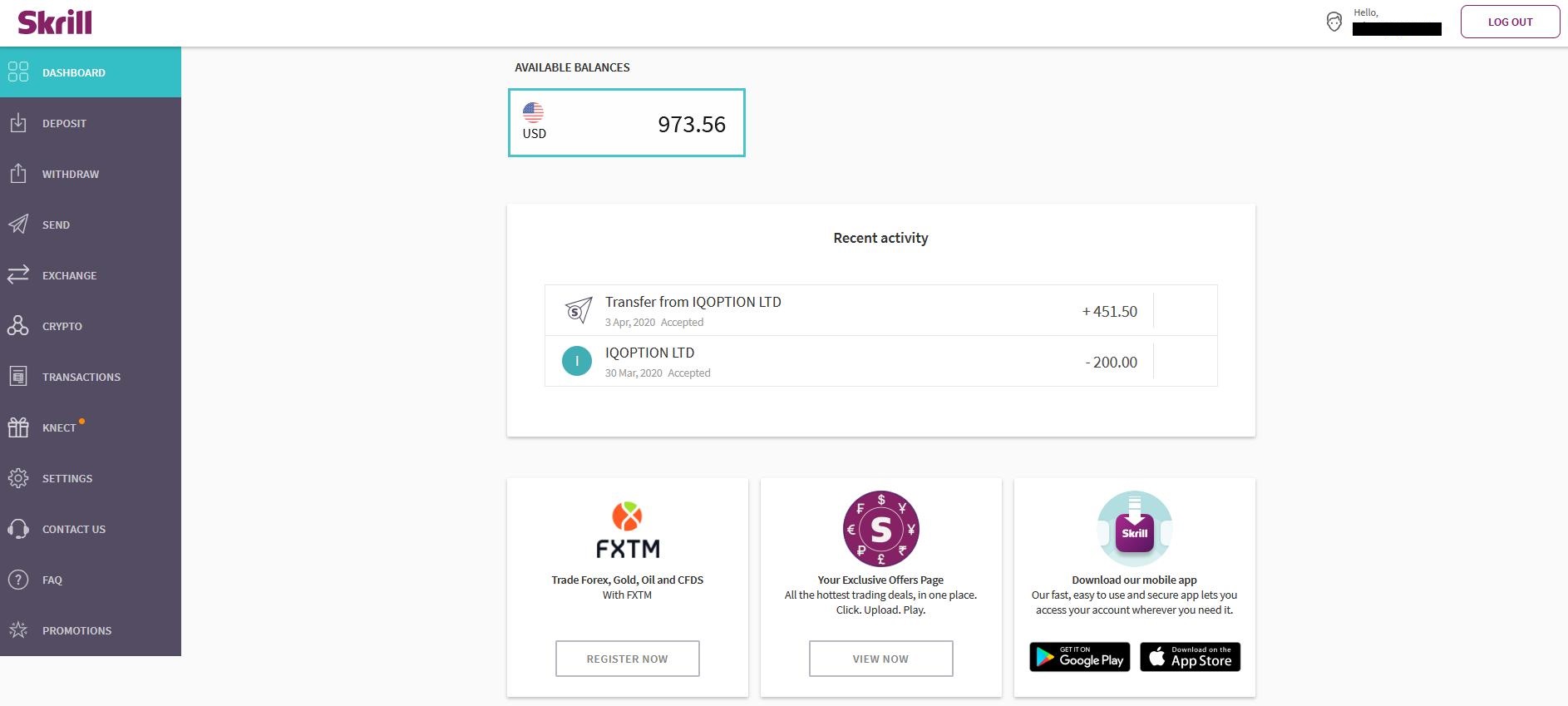

On Friday, the market started to rest. So I withdrew the money to my bank account to prepare a plan for reinvestment next week.

To conclude

This is the method I draw for myself during trading. So I understood all too well what to do and how to avoid the risk. If you think it is suitable for you, you can also trade with the T.L.S strategy. But if something goes wrong when you trade, you must take full responsibility for your decisions. You should trade with a demo account to understand how it works and what its advantages are to exploit.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu