![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

Have you ever seen a rainbow in real life? Surely, it is very beautiful and brings positivity to you. As for the Rainbow trading strategy that I am about to introduce to you, it will also bring happiness to you if you know how to use it to make profits stably. This is a method that closely follows the price action when using only 1 indicator, the EMA (Exponential Moving Average). Let’s read the article to know more right now.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

How to set up and trade with the Rainbow strategy

As mentioned above, the indicator of this strategy is extremely simple. It is 3 lines of EMA including EMA6 (lotus pink), EMA14 (purple), and EMA26 (blue). You can choose the color you prefer to make it look like a rainbow after the rain.

- The timeframe of the chart is 5 minutes.

- The expiration time is 15 minutes.

- Only trade when the market is trending.

The rules for entering orders are as follows.

To enter a HIGHER order, the trend must first be bullish. Next, the EMA6 must be above the EMA14 and EMA26. If the price pulls back to touch EMA14, open a HIGHER order immediately with an expiration time of 15 minutes.

To enter a LOWER order, we must confirm that the market is in a strong downtrend. At the same time, the EMA26 is clearly above the EMA14 and EMA6. Wait for the price to touch the EMA14 then immediately open a LOWER order with an expiration time of 15 minutes.

Capital management with the Rainbow trading strategy

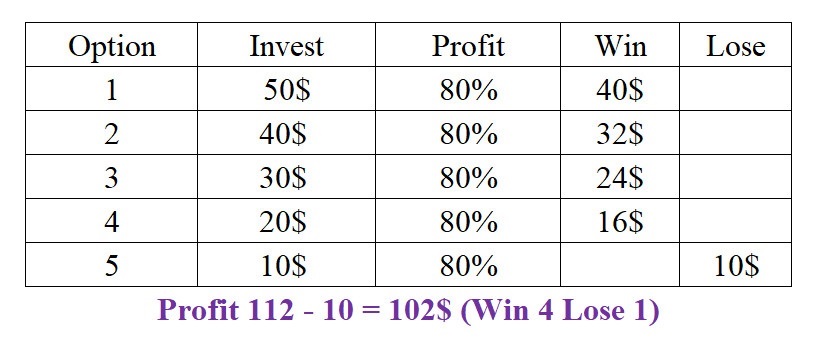

If a trend is formed for a long time, it is very easy to reverse. Therefore, the success rate of the first orders in an uptrend or downtrend is very high and it will decrease over time. So we should enter the following orders with a smaller volume than the previous order to reduce the risk.

With the above capital management style, we will make a lot of profit at the beginning of the trend. And with a small trading volume later, it will reduce the risk when the price reverses for optimal profits in a long bullish or bearish wave.

The benefits of using the EMA

– Identify trends: EMAs can smooth price charts. Observing the EMA helps traders capture the trend of price movements.

- The EMA is sloping up which means the price is going up and the market is in an uptrend

- A downward sloping EMA means that the price is going down and the market is in a downtrend.

- The horizontal EMA means the price is also moving sideways. At this time, the EMA will be noisy because the price continuously crosses this line.

– Dynamic support and resistance: The EMA is also known as moving support and resistance. Because it always follows the price and is often used as important support and resistance zones.

– Keeping abreast of market movements helps traders seize opportunities quickly.

– Easy to set up and easy to use.

Every strategy takes time to learn thoroughly. Maybe you just read and find it very easy to use then deposit money to trade right after. But don’t be in a hurry. You should test it first on the IQ Option demo account to see if it suits your personality and style or not. Investing is a long road. Those who are in a hurry often fail.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu