Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

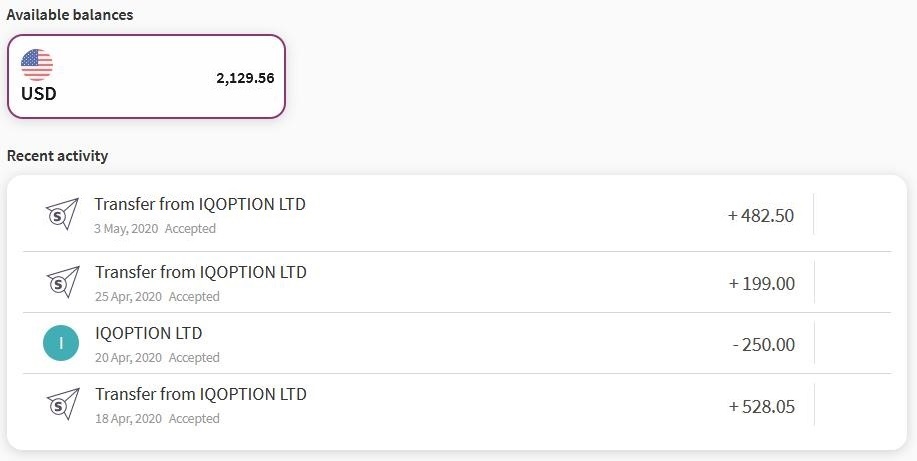

By the end of the 4th week of April, the profit earned from IQ Option is $232. We can consider it as a small achievement when applying the T.L.S strategy in financial transactions. In April, there were reviews of orders using the T.S.L strategy to analyze the effectiveness of it. Through that 4-week journey, what did you get? For me, I should minimize as much as possible the effect of emotions in trading.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Throw away your emotions during trading

Do you know why platforms prohibit trading using robots? Because robots perform transactions correctly without emotion. Emotions are what make traders lose money the most in financial transactions. So, avoid trading when your emotions are out of control.

Greed

Greed is a negative emotion that always dwells deep within each human being. It is the impossibility to be content with what has been and is present. It is also the desire to possess material things beyond your reach in an unfounded manner. That is when greed dominates you. It will quickly drown you into the illusion of wealth.

Greed will make traders more motivated to seek more profits. But you must know how to judge yourself whether you are able to achieve it or not. Make everything in your life under control and so do greed.

“Grasp all, lose all” is an old saying summarized from practice. Knowing to accept the present and to appreciate what we have has been a great success of a trader.

Fear

Fear is a negative and bewildering emotion produced when you encounter threats. Fear appears for both invisible and tangible threats. This is a natural human mechanism that helps you recognize danger. From there, it helps you prepare psychologically against that danger.

For traders, the fear appears after continuous losses. It creates bewildering psychology and fear of loss when entering transactions. Often, the things that you fear will likely happen to yourself sooner or later.

In trading, the fear helps traders be careful in each investment. But don’t let it scare you when analyzing a transaction. If the strategy conditions are sufficient, go ahead, and trade because this is a game of probability. Winning or losing is normal. Accept it as part of your trading.

Anger

Anger is a state of losing control of your emotions. This leads to overreacting actions to an event. Don’t let emotions control you because it can have serious consequences for yourself.

For a trader, it is easy to lose his temper when the profitable trading order suddenly goes lost. The feeling of being down can easily lead to loss of temper, which is followed by revenge. Sometimes revenge on the market makes investors pay a lot of money.

Anger does not help in trading or anything in life. So, stay calm even in the most unacceptable situations. Don’t let your emotions dominate. That is the most devastating thing a trader faces.

Accept losing as part of the process of making a profit. Anger is instinct but calming is bravery. Be a brave trader in a risky market.

These are the emotions that make traders lose their money the most. When you find the most effective way to control your emotions, you have overcome yourself. That brings huge invisible advantages during financial trading in IQ Option.

Set principles to control your emotions

– Do not open more than 5 orders a day. You must not let greed affect you every time you start and end a trade. Because 5 is the best number, neither too little nor too much for a day.

– The T.L.S trading strategy. If all conditions are fully met, open orders confidently without fear. This is the trading strategy that you trust the most, so why bother.

– Only trade with 3 currency pairs of USD/JPY, AUD/USD, EUR/USD. With few assets, it is not difficult to master their characteristics. Once you understand and become familiar with something, you are no longer afraid of it.

– Only open orders with the expiration time from 10 to 30 minutes. The longer the expiration time, the less emotional impact it will have. Less than 1 minute is the expiration time in which you are easy to get caught in emotional waves.

– Classic capital management method (balanced investment). It helps you not bother too much about the money invested and easily concentrate.

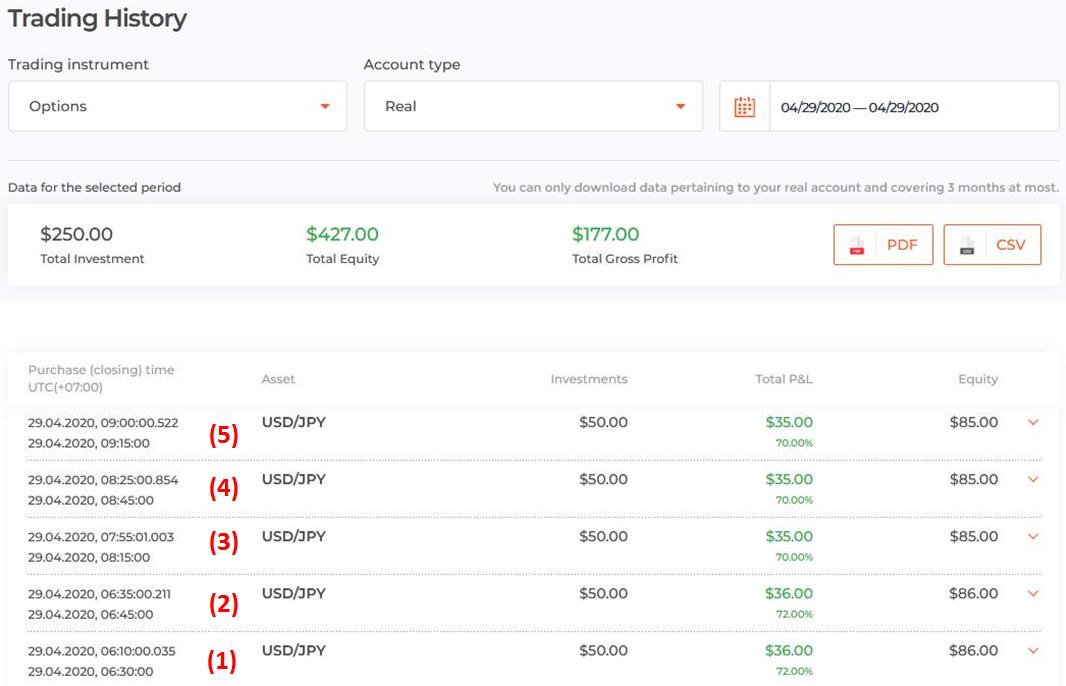

Review on trading orders in IQ Option on 29/04/2020

Entry signal

HIGHER = Bullish trend + support + signal candles.

LOWER = Bearish trend + resistance + signal candles.

Opened orders on 29/04/2020, with the T.L.S trading strategy

1st order: Downtrend + resistance + (Shooting Star) test candlestick Opened a 20-minute LOWER order.

2nd order: Downtrend + resistance + (Doji) test candlestick Opened a 10-minute LOWER order.

3rd order: Downtrend + resistance + (Shooting Star) test candlestick Opened a 20-minute LOWER order.

4th order: Downtrend + resistance + the price tested the level the second time Opened a 20-minute LOWER order.

5th order: Downtrend + resistance + test candlestick Opened a 15-minute LOWER order.

As soon as I opened the 5th order, I turned off my computer without knowing the result. Whatever it was, I still had to wait for 15 minutes. I’d rather go doing something else. The next day, I re-logged into my account and found out that this order was a profitable one when I correctly predicted the trend.

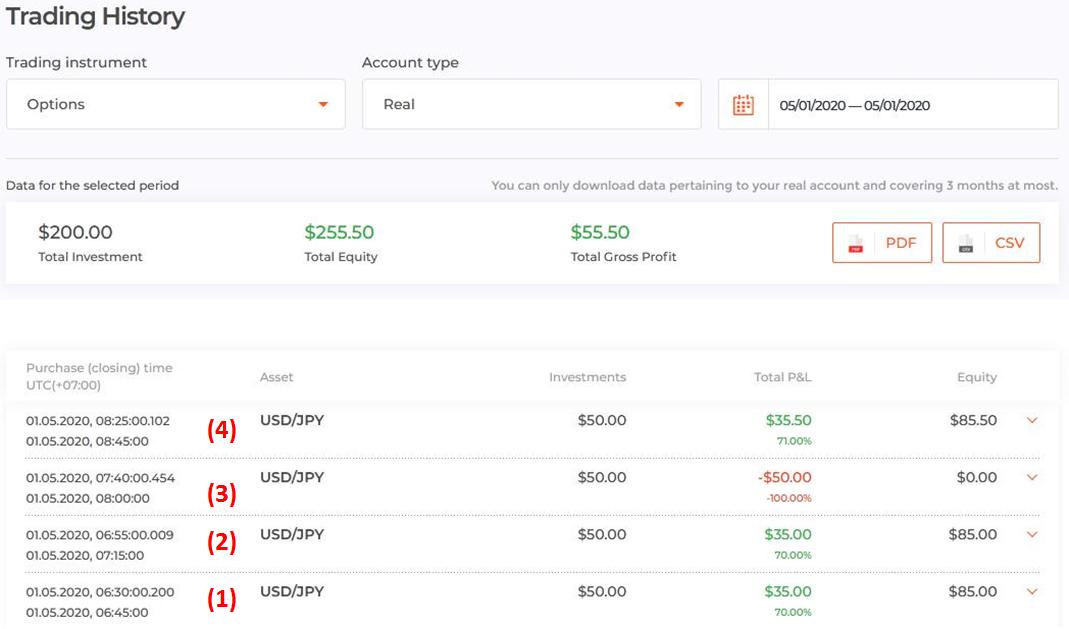

Review on financial trading orders in IQ Option on 01/05/2020

Opened orders on 01/05/2020, with the T.L.S trading strategy

1st order: Uptrend + support + test candlestick, the price tested the level it just passed. Opened a 15-minute HIGHER order.

2nd order: Uptrend + support + (Bullish Pin Bar) test candlestick. Opened a 20-minute HIGHER order.

3rd order: Uptrend + support + (Bullish Pin Bar) test candlestick. Opened a 20-minute HIGHER order.

4th order: Downtrend + resistance + (Doji) test candlestick Opened a 20-minute LOWER order.

The trend reversed from up to down with a weak force. The market could go sideways at any time so it was better to stop trading here.

The bottom line

So this is the end of the monetization series with the T.L.S strategy in April. You can manually define the effectiveness when you go through all the articles of each week. The most important thing for every successful or failed trader stays largely in emotional control. Train yourself to be calm in front of the market turbulence. If so, then finding profits will not be difficult anymore. I wish you success in every transaction.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu