Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

Have you ever found your mind empty while your account kept going down to 0? Maybe you have not known the rules of the game to make favorable decisions for yourself. You are hopelessly searching for profit without understanding the nature of things. This article will help you expand your knowledge of how the trading game in IQ Option keeps you losing.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Reasons why you cannot win when trading in IQ Option

Maybe these are things you encountered during the trading but you didn’t realize. If you know these mistakes well and fix them, your trading results will probably be different.

Trading is to bet with brokers

Do not think that you are dealing with financial markets when trading. What a mistake. You are betting with the brokers, not with any other traders. Its operation is just like the casino of the 19th and 20th centuries but located in the 4.0 era. It makes the brokers pay no taxes and minimize the operating costs. In some countries, it is unpopular because it brings no benefit to them. So most countries in Europe have very strict laws or prohibit this type of investment.

In essence, trading is very close to gambling. Between them is only a small line. Just changing in emotions will turn it from investing to gambling. It is like tossing a coin and then betting if it tails or heads to differentiate between winning and losing.

But when you use technical indicators to open orders, it’s now some kind of serious work. Gambling or investing also depends on the mindset of each person entering the trading game. If you have already had gambling blood, I advise you not to trade.

A severe win rate

By opening an order, you have lost 15-20% of your money for your investments. If you win, you get 80% of your investment. But if you lose, you lose all your initial investment. It is hard to accept when you know in advance that the profits have been partially reduced. But that is the cost used for operating and that is inevitable. Whether you trade or not is your choice. No one can force you to. If you feel too disadvantageous, then don’t participate.

Brokers can control candlesticks and time

That is completely true when the platforms are operated by their staff. If you always win, how can they get the money to keep the organization running? There will be times when the brokers affect the prices of small time frames to take advantage. However, reputable brokers will never do this to take money from traders.

What they do is create many tools to help you analyze price movements quickly. From there, you will notice many opportunities to open orders and then make your account worn down by the win rate. Be alert waiting for real opportunities. They will come but not as often as you think.

The issues above are the most basic. If you are overwhelmed by the market, you will realize that my share is correct. From there, you can draw experience every time you fail and avoid repeating them in the future.

Things you need to do to become the winner

You should understand that if you do not invest properly, you are just a gambler. But if you have a specified plan to gamble, you’re investing. This only means that investing with a specific strategy is different from gambling. We do not recommend that you take money to gamble.

In this article, I only show you how to manage capital and how to trade to make profits. Being profitable or not depends on the winning rate of the strategy you apply.

Martingale capital management method with control

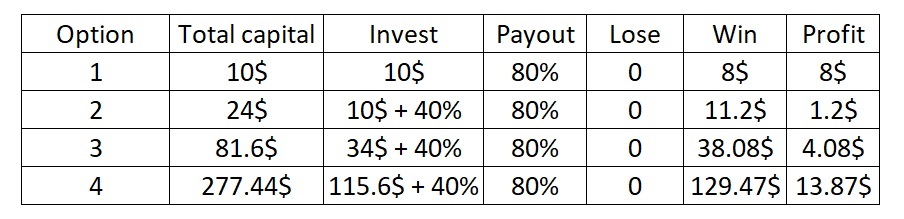

As mentioned above, when you open an order, it takes 15-20% of your invested capital. That is if you lose the 1st order of $10, then on the 2nd order, you have to invest 30-40% more than the previous one. When winning you must return to the initial investment of $10.

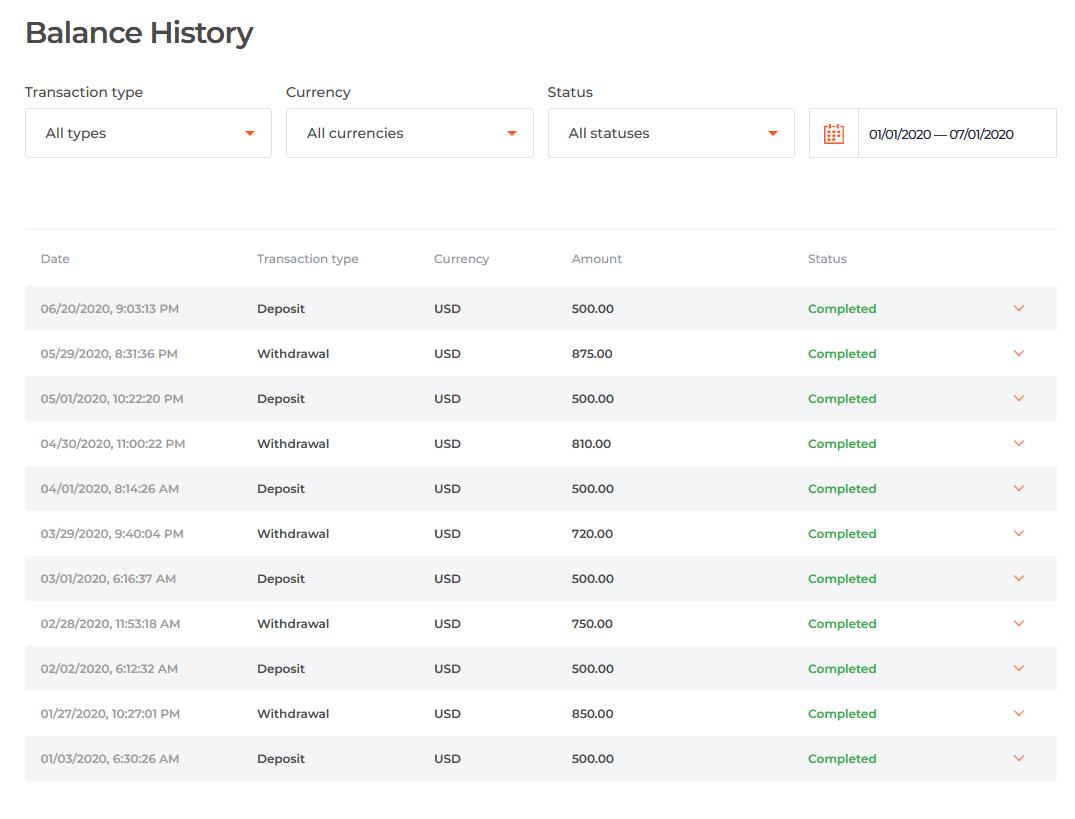

I have experienced the market for 3 years. If you can overcome the initial bitterness, success will come. With a $1,000 account, I applied the above IQ Option trading strategy, which brought about very satisfactory results after a long year of statistics.

Notes: For the 1st order, you should invest 0.1 – 0.3% of your total capital (apply it on a Demo account first).

With the above method, you only need to win 5 out of 10 orders to make a profit of 15-20% with the payout rates of the brokers.

Trading principles are the key to success

- Before you start a trading session, you must calculate two things in advance. The first is the maximum percentage you accept to lose without burning out your account. And the second is the maximum profit rate for a day that you accept to stop trading. I am applying 5-7% per day for compound interest and 25% for the maximum risk level.

- Do not trade at times when there is often news of strong fluctuations. You will never know the direction of the candlesticks when there is news.

- Don’t trade without knowing what the market trend is. Should not open orders with short time frames of 5 minutes or less.

- To determine the correct trend, you should open some demo orders before opening a real one. You need to improve your knowledge by studying more candlestick patterns, special candlesticks, etc.

- Test it in advance with a Demo account and you will find surprises. There is no need to care about indicators that brokers want you to focus on. Indicators are not always correct.

- For this strategy, you can even trade when the market is sideways. Winning 5 out of 10 orders is profitable. Winning 4 out of 10 orders is still profitable depending on how you invest.

One last word

This is the result of trading after a long time of testing the trading strategy with my own IQ Option account. If you already have a trading strategy, try this capital management method with a Demo account. When you can stay profitable for 3 consecutive months, then you can start trading with the above strategy.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu