Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

What if your trading is like a machine? If everything goes in line with the strategy, then enter the trade. I guarantee you will definitely be the one who makes a steady profit in IQ Option. To be a money-making “robot”, you should set up a cause-effect clause. If the market creates a Bullish Engulfing candlestick pattern, the price will increase in the near future.

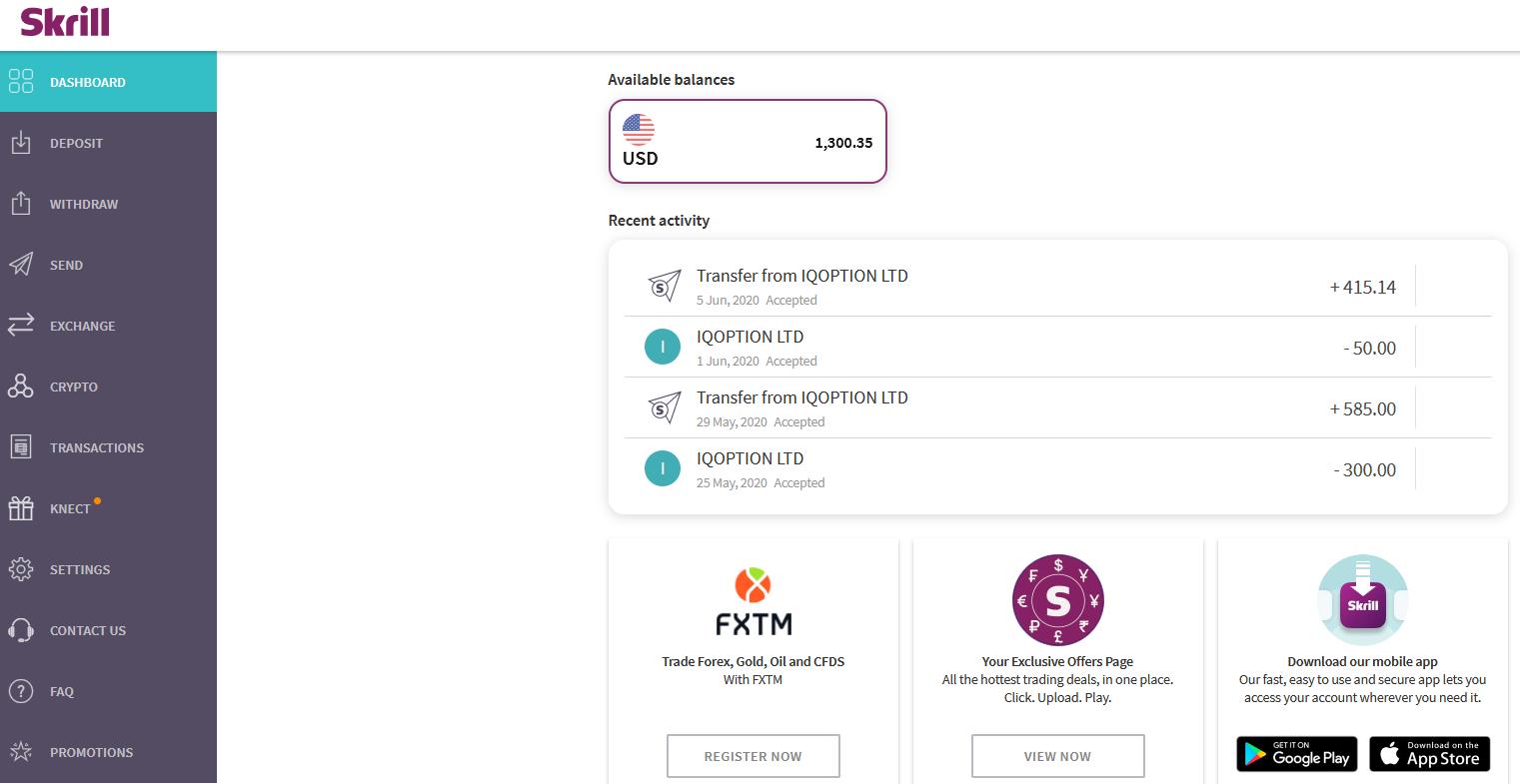

This article will guide you to forecast the future market when the Bullish Engulfing pattern appears. If you can do so, earning $400 like me is not too difficult.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

What is Bullish Engulfing?

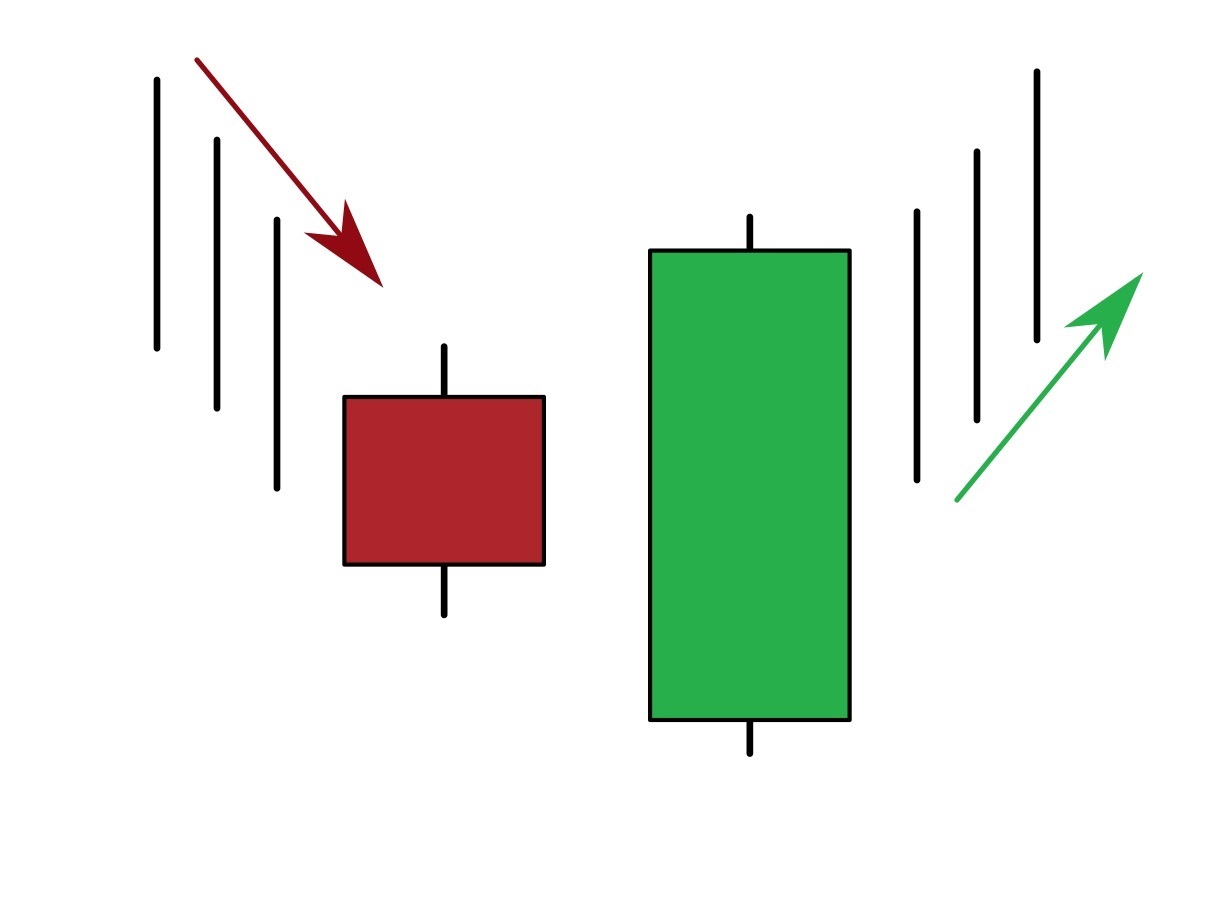

Bullish Engulfing is a strong reversal candlestick pattern from bearish to bullish. If you look at the trading experts, you will notice that they only open HIGHER orders when they see the Bullish Engulfing. This is a positive signal from investors hoping the market will increase in price. They have high accuracy when appearing in an exhausted downtrend.

The Bullish Engulfing candlestick pattern consists of 2 candles as follows:

First candlestick: is a bearish candlestick with a moderate body.

Second candlestick: is a strong bullish candlestick that covers and clears the bearish momentum of one or more previous bearish candles.

Meaning of the Bullish Engulfing candlestick pattern

The Bullish Engulfing candlestick pattern brings up bullish momentum, ending an exhausted downtrend. The downtrend has exhausted through small indecisive candlesticks or Doji candles. Any level or trading volume from the buyers can reverse the trend easily.

When prices rise in such a rush, the only way to make money is to open a HIGHER order.

Bullish Engulfing candle pattern variants are different in appearance but the meaning is still the same. The market is completely controlled by the bulls when the Bullish Engulfing candlestick appears.

Signaling a breakthrough of the market in the future

The market falling is like a diver. When reaching a certain depth, the oxygen is not available, it is impossible to go deeper. Based on those rules, traders will find the exhausted points and open a reasonable reversal order there. At first glance, it may seem difficult but actually, it is very simple for experienced traders.

Whenever the Bullish Engulfing pattern appears, you can find an appropriate entry point to open a HIGHER order.

What does the crowd think when the Bullish Engulfing appears?

The moment the Bullish Engulfing completely appears is when the buyers overwhelm. If forced to participate in the market, the majority will choose the “bull” side because this is the game of the crowd. Never go against the crowd. They are very primitive. Follow them or stand outside if not yet decided.

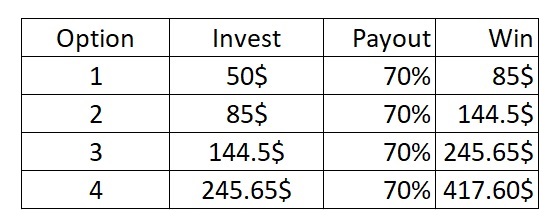

Snowball capital management method

The Snowball (compound interest) method can be considered as a double-edged sword for investors. If used properly, your balance will quickly multiply, otherwise, you will lose in the blink of an eye. If you are a person with a lot of patience then I would like to propose the Snowball capital management. Being patient with a high winning rate will make your account bigger for a while.

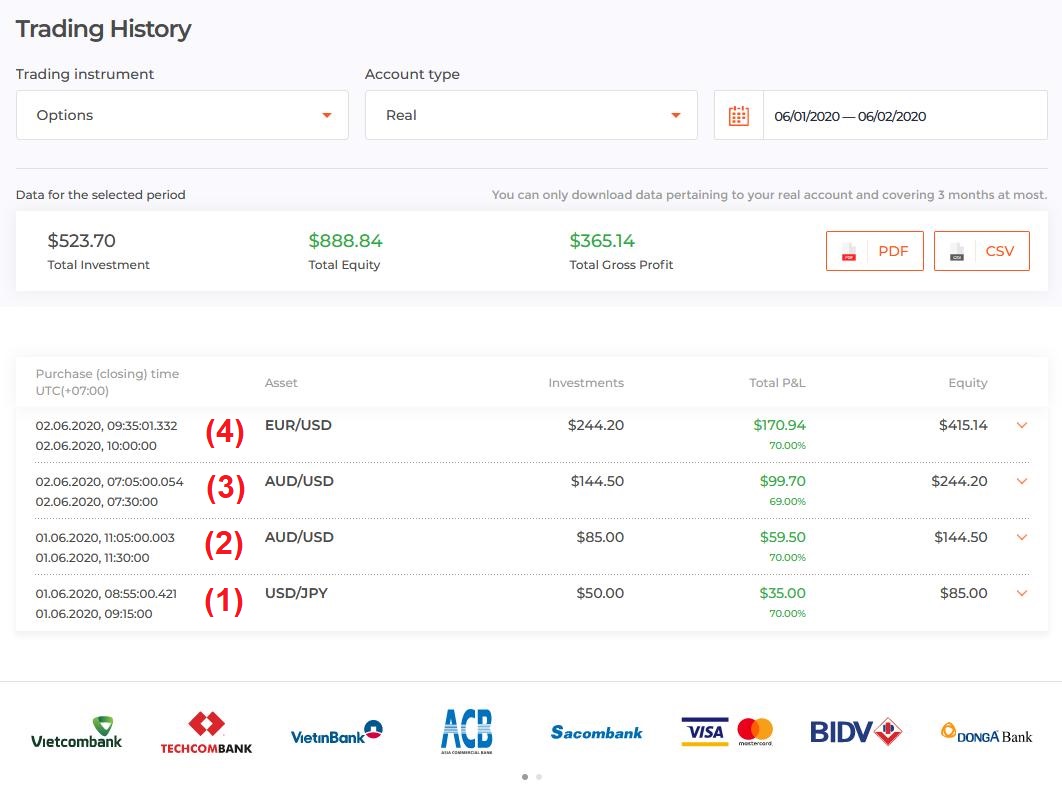

Review on financial trading orders in IQ Option from June 1 to June 2

Open a HIGHER order when: The Bullish Engulfing candlestick pattern appears.

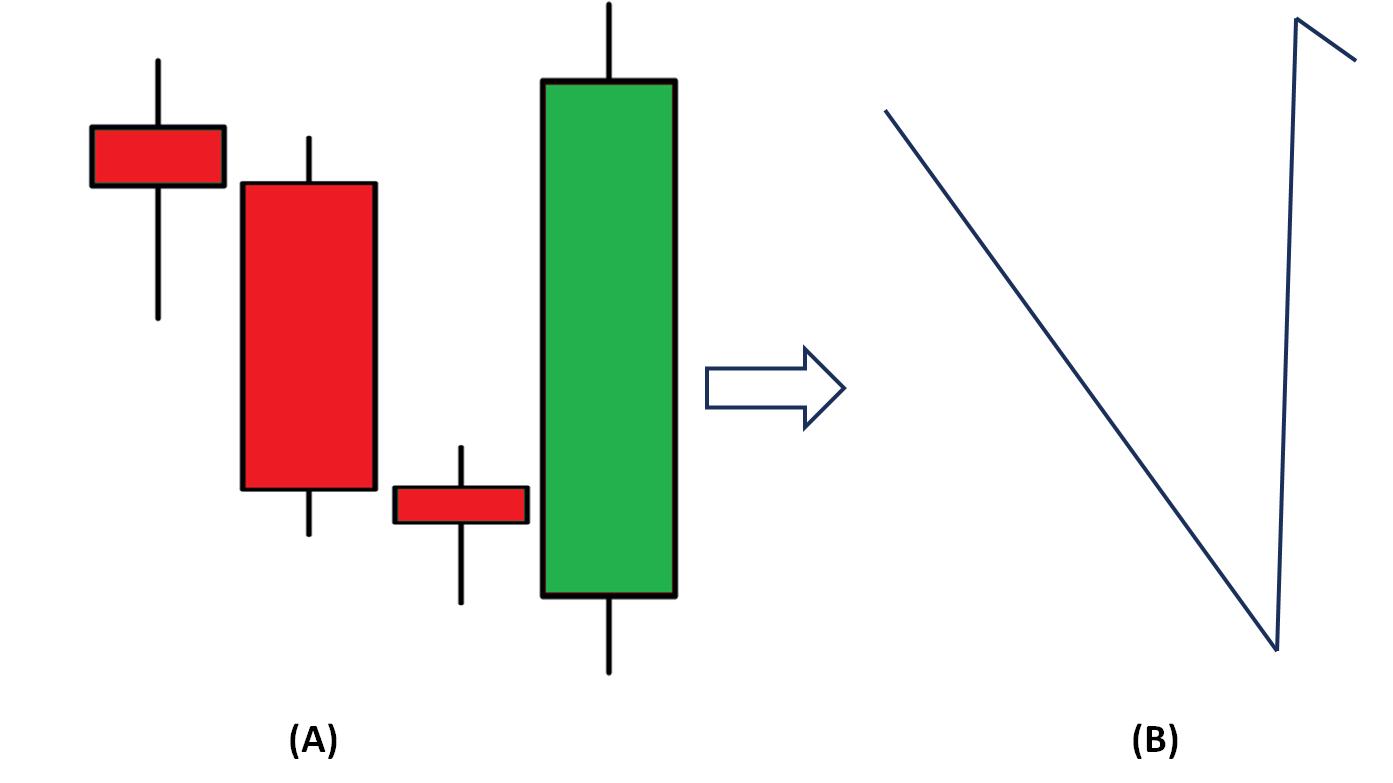

Reasons for opening the 1st order: The bearish trend slowed down through bearish candles with small bodies. A Bullish Engulfing candlestick pattern appeared, forecasting a reversal from decreasing to rising. There, traders were eligible to open HIGHER orders.

Opened a HIGHER order with an expiration time of 20 minutes.

Reasons for opening the 2nd order: The downtrend was exhausted. When the Bullish Engulfing pattern appeared, the downtrend ended. The market would reverse in the near future when the sellers were weak.

Opened a HIGHER order with an expiration time of 25 minutes.

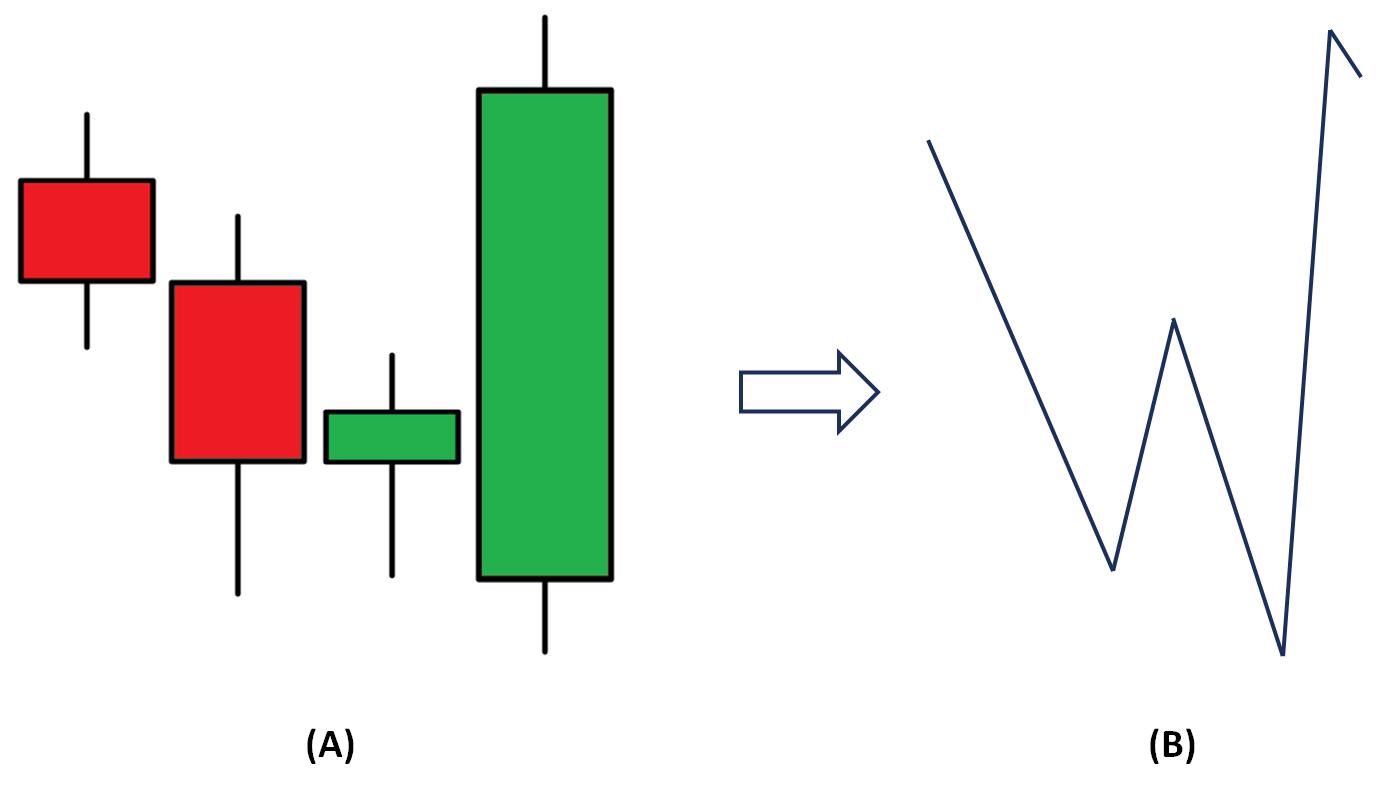

Reasons for opening the 3rd order: The downtrend shaped like waves. And the following waves got smaller showing that the bullish force had gradually dissipated over time. The Bullish Engulfing candlestick pattern completely covered the last bearish wave, signaling the end of the downtrend.

Opened a HIGHER order with an expiration time of 25 minutes.

Reasons for opening the 4th order: The downtrend was long and stable. There were many candlesticks with long lower tails forming a support zone right below. The bullish candlestick pattern formed on the previous support. This was eligible to open a HIGHER order.

Opened a HIGHER order with an expiration time of 25 minutes.

In one word

Even newbies can open winning orders if they stay disciplined. According to the above sharing, you will find it very easy to implement. But in order to have such entry points with a high winning rate, the waiting time is a lot.

The Snowball capital management is also risky and requires caution on each order. Remember to only open orders at the entry points with the highest probability of winning.

If you use the Engulfing candlesticks, you must manage your capital using the Snowball method. This is a perfect match like fish to water.

Experience the Bullish Engulfing and Snowball strategy on a demo account. When you stay profitable continuously within a month, you can think about making real money.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu