Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

The financial market operates like a loop that repeats randomly. Successful traders will know how to follow the loop to move up the financial ladder. In order to do that, you need to combine your knowledge with trading skills perfectly. This article will describe that process and how to earn $416 profit within 4 trading days in IQ Option using the Bearish Engulfing candlestick combined with the Snowball capital management method.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

What is Bearish Engulfing candlestick?

Bearish Engulfing is a strong reversal candlestick pattern from up to down. We can consider it as a reliable signal for opening a LOWER order whenever it appears. All traders consider opening a LOWER order when encountering the Bearish Engulfing candlestick pattern on the chart

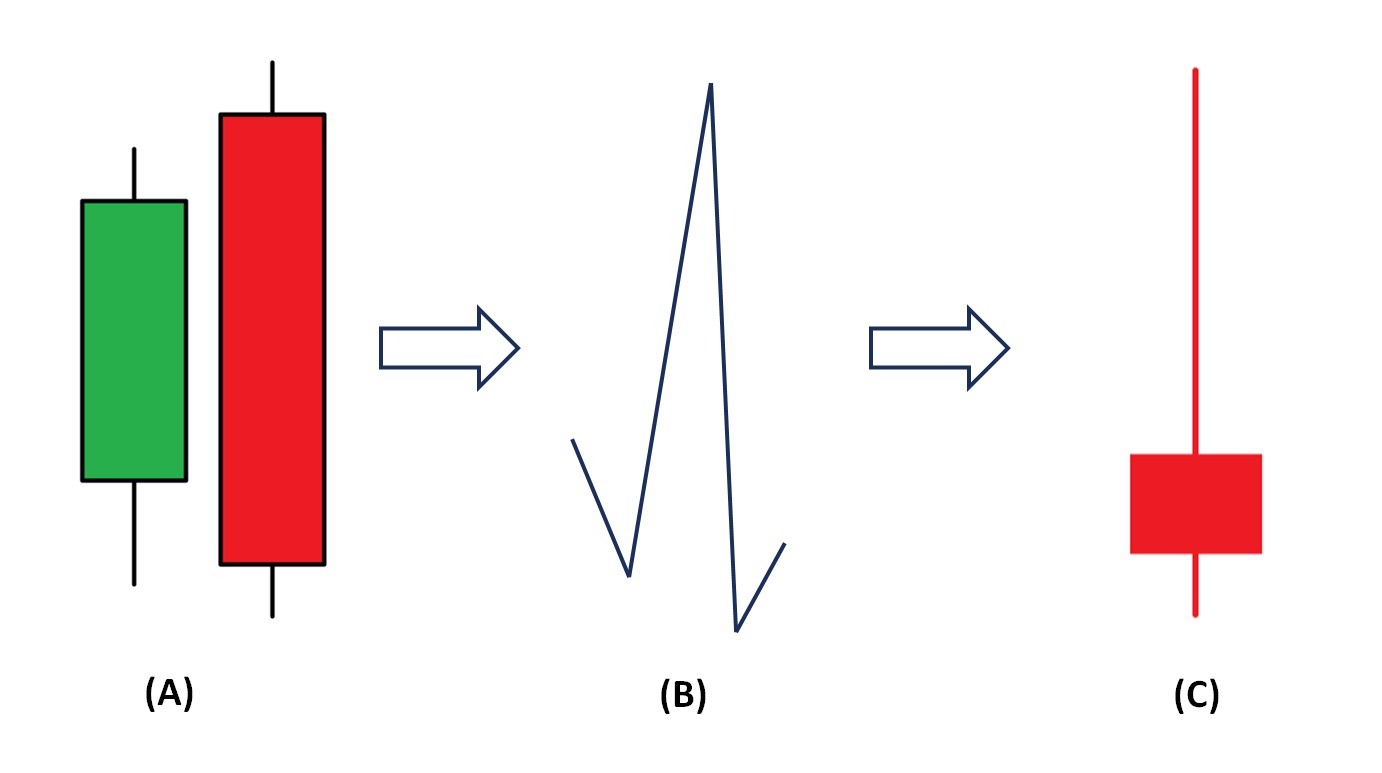

Each pattern has a difference for traders to identify and open orders logically. The Bearish Engulfing candlestick pattern consists of the following two candles:

– First candlestick: is a bullish candlestick with a small body (It’s better if it is a Doji).

– Second candlestick: is a strong bearish candlestick with a long body covering one or more of the previous bullish candlesticks.

Bearish Engulfing candlestick pattern meaning

When the price goes through a long uptrend, it exhausts and cannot push the price higher and further. That is when you will encounter small bullish candlesticks showing market hesitation. At the end of the uptrend, the sellers are likely to stop the upward momentum, making the market reverse.

When a long bearish candlestick appears, it proves a strong entry by the bears making the price sharply lower. At that time the opportunity to open a LOWER order occurred as soon as the pattern formed.

(A) Standard Bearish Engulfing candlestick pattern.

(B) The price direction when the Bearish Engulfing candlestick pattern appears.

(C) Combining the candlesticks of the Bearish Engulfing pattern will give us a special candlestick pattern called Shooting Star.

=> That’s all we need to know when using the Bearish Engulf candlestick pattern for opening orders. Only open LOWER orders when you see this pattern because it shows the market pessimism. This is commonly used as a high-precision reversal prediction pattern.

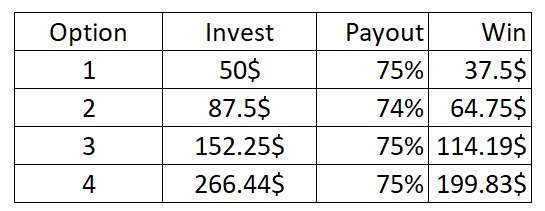

Snowball capital management method

This is the capital management method used only for trading orders with a winning rate of over 75%. And the Bearish Engulf candlestick pattern can meet that requirement. But what few people know when using the compound interest to open orders is patience to avoid losing money. Because it uses both the capital and the profit of the previous order to open the next one. So it is in need of safety.

For example, You open the first order with an investment of $50. When you win, with the 75% payout rate, you will receive $87.5 in total. When you open the 2nd order, the investment amount including the principal and profit is $87.5. Keep going until the end of the set trading cycle. But do not exceed 4 consecutive orders using compound interest as this is a probability game. Anything unexpected can happen in any situation.

Notes: Do not use this capital management method when you are not aware of the risks. Don’t listen to the fancy sayings that make you think this is the fastest way to make money. The advantage is that it makes your balance bigger quickly but it also goes with risks. What professional traders are most concerned about Snowball is that you will lose both principal and interest for any losing order.

Trading skills

This is something that no one can help you improve but yourself. This is the perception and understanding of market movements during the investment process. And you will know what to do when the market is not as predicted. Your skills will then help you to make effective decisions based on technical indicators. Premonition is too vague and uncertain. We need to get rid of it when opening an order.

=> Please trade with a demo account to train your best trading skills. In decisive moments, skilled people know what to do to avoid risk. Practicing to protect your money will never be redundant.

Review entry points in IQ Option from May 18, 2020, to May 22, 2020 with Bearish Engulfing candlestick

Pic: All online orders opened in IQ Option from June May 18, 2020, to May 22, 2020

Only trade with the AUD/USD currency pair.

May 18, 2020

Reasons for opening the 1st order: The price tended to increase slightly through small bullish candles. But a strong bullish candle caused the price to break out and exit the current price channel and created an uptrend.

After that, the subsequent bullish candlesticks with a long upper tail compared to the body indicated an uptrend rejection. Finally, a long bearish candle engulfed the upwards momentum and formed the Bearish Engulfing candlestick pattern.

Opened a LOWER order when the Bearish Engulfing candlestick pattern appeared. The expiration time was 20 minutes.

May 19, 2020

Reasons for opening the 2nd order: The price was in a weak downtrend but getting stable over time. And then a bullish candlestick with a long body tested the previous resistance.

After that, a long bearish candle erased the bullish momentum and solidified a downtrend in the future. At the same time, the Bearish Engulfing candlestick pattern formed right at the resistance. At this point, you could safely open a LOWER order when the trading conditions were met.

Opened a LOWER order when the Bearish Engulfing candlestick pattern appeared at the resistance zone. The expiration time was 25 minutes.

May 20, 2020

Reasons for opening the 3rd order: The trend was up but the bullish momentum had weakened through bullish candlesticks with small bodies. When the uptrend started to exhaust, the sellers joined to push the prices down overwhelmingly.

At that time, the Bearish Engulfing candlestick pattern formed and the second candle was a Break Out candle. There were sufficient conditions to prove opening a LOWER order was the safest thing.

Opened a LOWER order when the Bearish Engulfing candlestick pattern appeared at the resistance zone. The expiration time was 20 minutes.

May 22, 2020

Reasons for opening the 4th order: The price could not surpass the resistance level after many touches. In the last attempt to break through the resistance zone, a bearish candlestick with an overwhelming long body appeared. The bearish engulfing candlestick pattern then formed at the very strong resistance. Even the fastidious traders agreed to open a LOWER order without hesitation.

Opened a LOWER order when the Bearish Engulfing candlestick pattern appeared at the resistance zone. The expiration time was 15 minutes.

To conclude

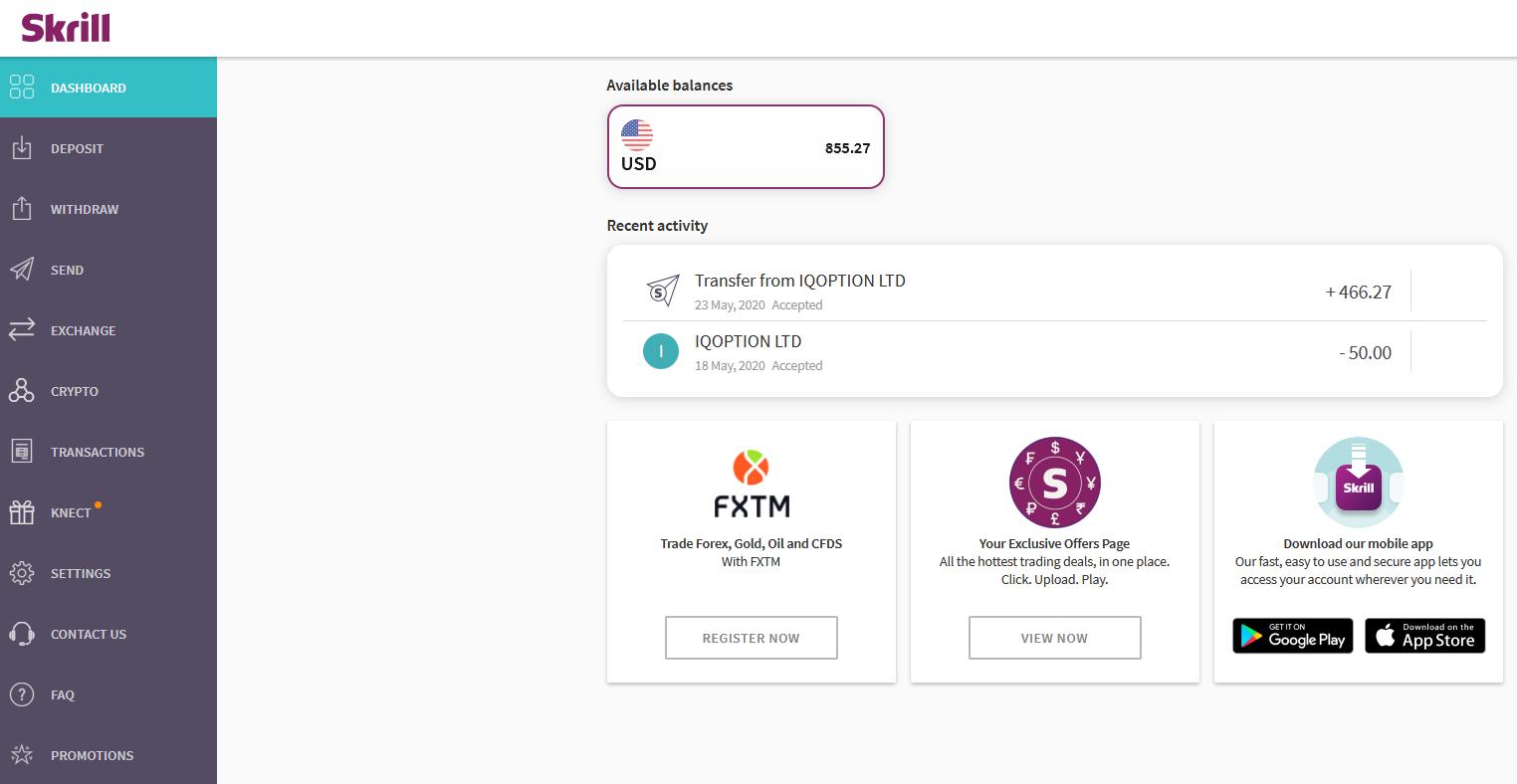

Protect your account by withdrawing both principal and profit to your e-wallet at the weekend. Restrict trading on the OTC market. Use the profits earned to treat yourself. Spend time with family, friends, and relatives to see life more meaningful. Do not be engrossed in seeking profits but losing your existence in society.

Do you know why the market tends to fall more often than to go up? The secret revealed by experienced traders is that “Fear is always 3 times greater than greed”.

Trade on a demo account to feel the price movement of the market clearly. Once you master it, making an account grow bigger is just a matter of time for you. Do not let yourself have a chance to fail. Always seek certainty in each trade.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu