![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

Have you ever wondered why professional traders make profits and you don’t? It’s because they use safe trading strategies to make profits in the long run instead of trying to get rich quickly. And one of the safest strategies they love is the Supply and Demand zones.

These zones are where the Big organizations (investment funds, super banks, large commercial companies, the government…) make their moves. When trading following the “Big Bosses”, you have a high probability of making a profit. It’s just that simple.

Now let’s learn how to determine the Supply and Demand zones in IQ Option.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

What is the Supply zone?

The supply zone is where the price drops significantly.

When supply exceeds demand, the price will move. It goes down because the quantity supplied exceeds the demand for a certain item at present. There is an imbalance between sellers and buyers (more sell orders than buy orders).

The price may struggle before falling completely, forming a zone called the supply. When the price goes to this zone, it’s time for you to look for opportunities to enter sell trades.

If the market has an imbalance when supply is greater than demand, there will be a lot of “unfilled” sell orders in this supply zone. Then, if the price turns back, these “unfilled” orders will be matched. The price will fall sharply again when the excessive selling volume occurs suddenly.

What is the Demand zone?

The demand zone is where the price increase dramatically.

When demand exceeds supply, there is a shift in price. The price is pushed up due to soaring demand and limited supply. At this time, there are more buyers than sellers. If the price has a pullback before rising, we call it a demand zone. You need to look to buy in the future if the price returns to the demand zone.

Reason: When there is a strong imbalance, it also means that there is an “unfilled” buy order in the demand zone. When the price hits it, these orders will be executed, pushing the price up again.

How to determine the standard Supply and Demand zones

To have good entry points, you must find the standard supply and demand zones. Because that is the time when your order is the most secure when trading according to Big Bosses.

In the rest of the article, I will show you how to determine the Supply and Demand zones. This is an important skill that you need to master with this strategy.

How to determine the Supply zone

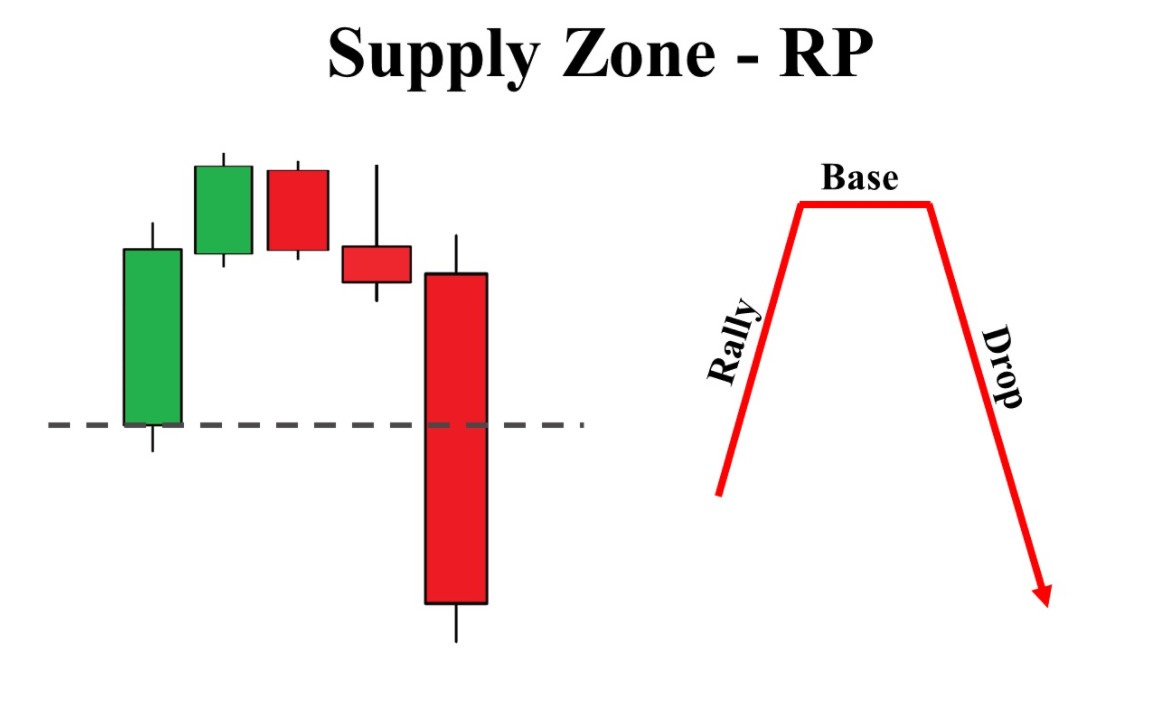

There are 2 common patterns of the supply zone: (1) RP – Reversal and (2) CP – Continuation.

(1) RP – Reversal pattern: Rally – Base – Drop

The price moves sideways after a period of uptrend, creating a zone called the Base. Then it falls sharply with a long body candlestick. This base is the reversal supply zone (RP).

The series of 11 sideways candlesticks in the picture above is the Base. When the price of the AUD/USD currency pair plummets, creating a long body bearish candlestick, this Base becomes the reversal Supply zone.

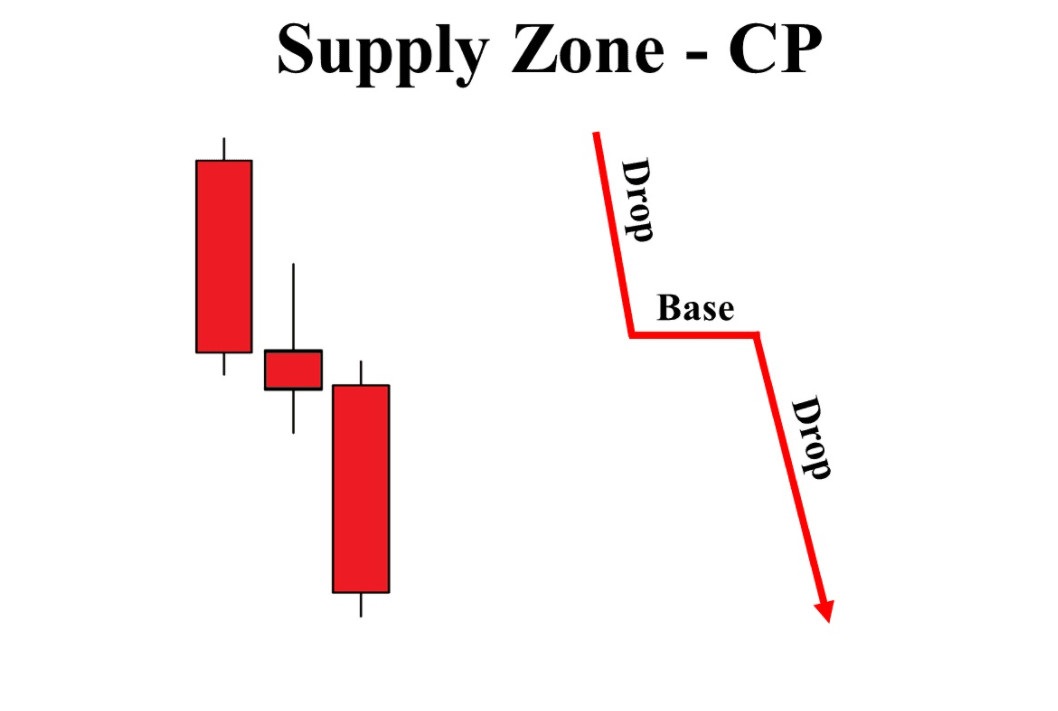

(2) CP – Continuation pattern: Drop – Base – Drop

The price stops falling and forms sideways candlesticks, then continues to fall sharply again. The base in this process is the Supply zone.

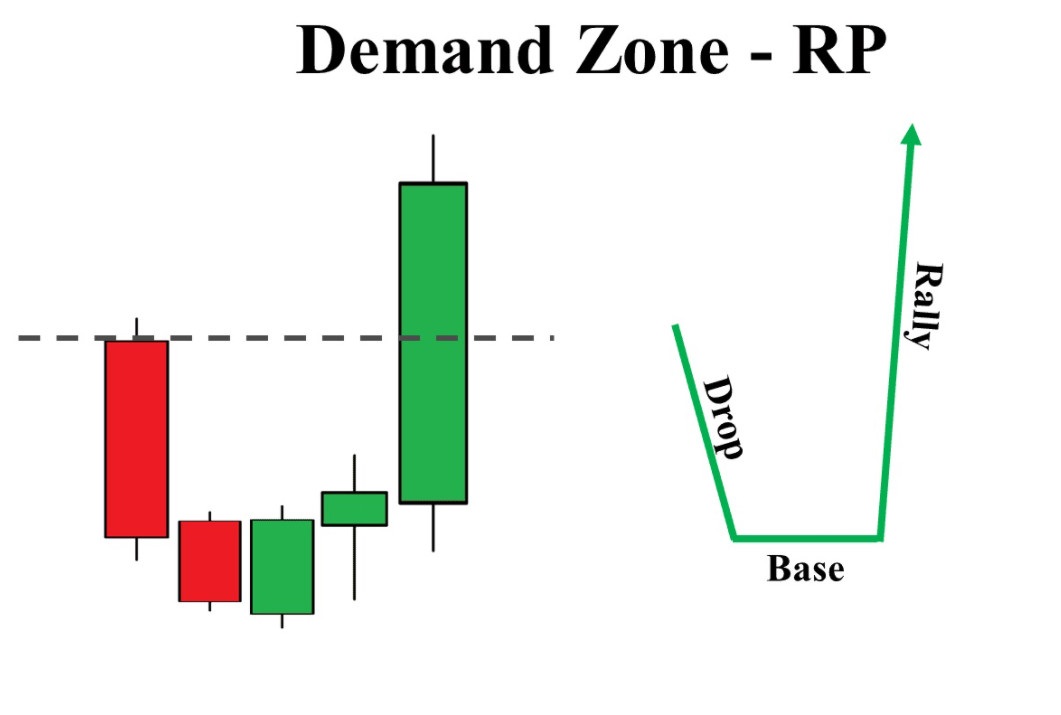

How to determine the Demand zone

Similar to the Supply, we will focus on the Base and sudden strong bullish candlesticks.

(1) Reversal pattern RP – Drop Base Rally

When the market bounces back and creates a long green candlestick, the Base will be the reversal demand zone.

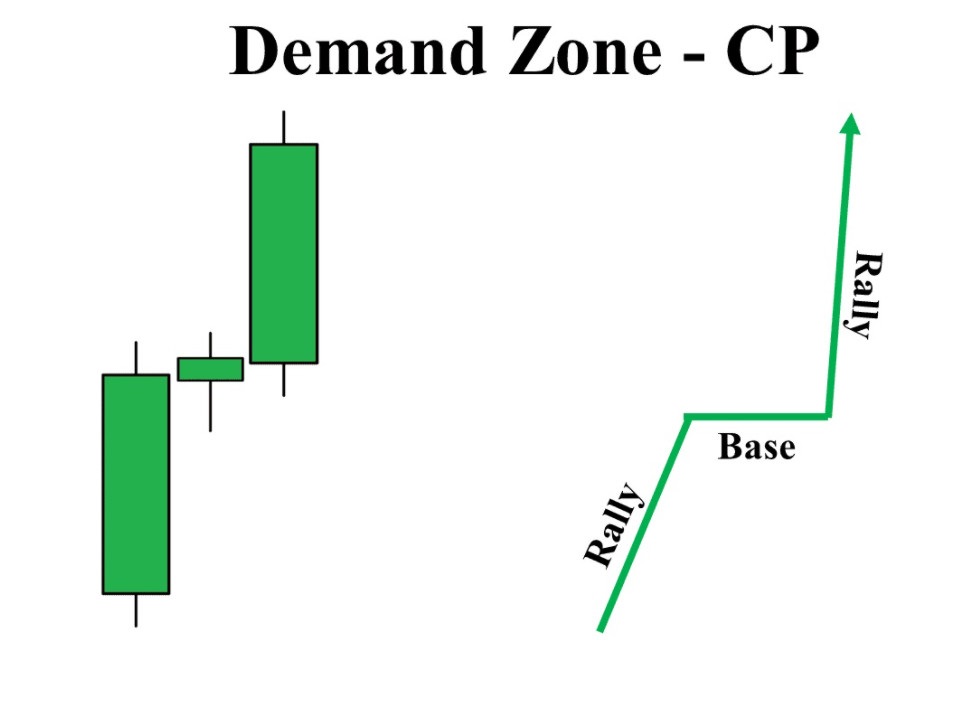

(2) Continuation demand zone (CP) – Rally Base Rally

The price starts to slow down with a series or just a single small body candlestick. That base is called the Demand zone.

Summary

So the secrets of making profits from professional traders have been revealed through this article. They are the supply and demand zones where the big organization will execute their trades. Your job is to follow that trail to open the safest orders. Let’s practice determining these zones on the IQ Option chart. That is the key to unlock the trading treasure.

Let’s look forward to the next article. I will show you how to place orders with the Supply and Demand zones.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu