![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

This is one of the daily making-money strategies of longtime IQ Option traders. Triple candlestick is simple. It’s an easy to access pattern but very effective. Today, I will show you how to trade with this pattern in IQ Option (trading clip included).

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

IQ Option trading rule with Triple candlestick

The rule is simple. For every 3 consecutive red candlesticks, you bet the next candlestick green. Conversely, after every 3 consecutive green candlesticks, bet the next candlestick red. Moreover, combine it with Martingale capital management.

For example, 3 consecutive green candlesticks => Bet the 4th candlestick red. So 3 green candlesticks are the signal for you to open an option on the 4th red candlestick.

This is a strategy based primarily on statistical probability in IQ Option. Just like how you tossed a coin. When it falls, the probability of heads or tails is 50/50. The probability for 3 consecutive tails is 12.5%. Thus, from the 4th time onwards, you start to bet on the heads. The probability of winning will be higher.

How to trade with Triple candlestick pattern in IQ Option

Step 1: Choose currency pairs (trading products) and Japanese candlestick chart

Only a few currency pairs and some trading hours meet the requirements of this strategy. The reason comes from the strong volatility of the market. It is affected by the impact of good and bad news. Therefore, you must know the right time and currency pair.

For example, in the Asian session, you can choose EUR/USD. In the European session, you can choose AUD/USD. Hence, news from these markets will not impact the currency pair you trade.

Next is the Japanese candlestick chart. You can choose the candle time period from 2 minutes or more. It is best to use the 5-minute or 15-minute candlestick chart.

Step 2: Distinguish the types of candlesticks

Basically, candlesticks in IQ Option have 2 colors. They are green and red. There are also many different shapes of candlesticks such as Doji, Hammer, Shooting Star, etc. However, there is only one type of candlestick for you to trade with Triple candlestick pattern. It is the standard candlestick.

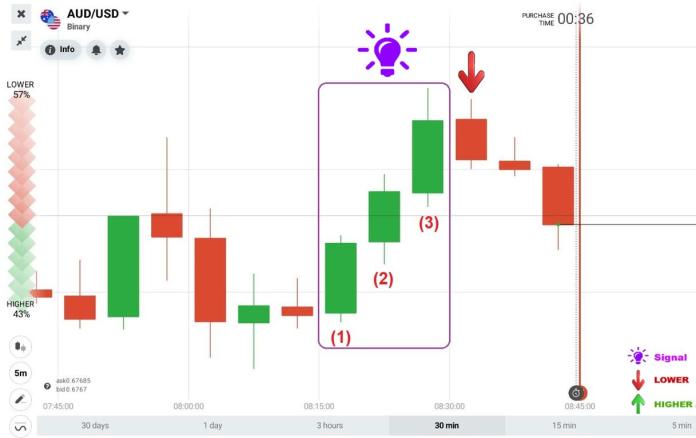

To know how to count candlesticks, you can see the picture below. The numbered candlesticks are counted as standard candlesticks. The circled candlesticks are special candlesticks (not included in the Triple candlestick pattern). Every 3 green standard candlesticks => Bet red for the next candlestick. On the contrary, 3 red standard candlesticks => Bet green.

EUR/USD Currency pair

AUD/USD Currency pair

USD/JPY currency pair (with the clip in the below part)

Step 3: Open options in IQ Option

If you don’t know how to trade with candlestick colors, read this article. How to trade with candlestick colors in IQ Option.

Formula: 3 consecutive standard green candlesticks => bet the next 4th candlestick red. On the other hand, 3 consecutive standard red candlesticks => bet the next 4th candlestick green.

The time you open the option = the time the 4th candlestick begins. The expiration time = the time this 4th candlestick closes.

For instance, the picture below with 5-minute Japanese candlestick chart. Open the option when the 4th candlestick starts at 11:20:00. The expiration time is 11:25. It’s the same time when the candlestick ends. At this moment, purchase time is 4:30.

Step 4: Prepare for the next option

Stay focused if you trade IQ Option following the three candlesticks pattern. I usually call each time I open an option as a trading cycle. The trading cycle only ends when there is a winning order. Each cycle has a maximum of 3 consecutive options.

Therefore, when the 1st option is near the end. You must prepare for the next option by changing the expiration time = the time the next candlestick ends.

For example, a 5-minute Japanese candlestick chart produces 3 consecutive green candlesticks. You start betting on the red candlestick (LOWER).

The 1st option loses. You increase the money and continue to bet on the red candlestick (LOWER) for the 2nd option. If you win any one option, that cycle ends and no more trades are opened.

Detailed clip on how to trade IQ Option with candlestick colors

Example 1 with EUR/USD, 3 consecutive green candlesticks => Bet the next candlestick red. This cycle wins in the 1st option.

Example 2 with AUD/USD currency pair, 3 consecutive red candlesticks => bet the next candlestick green. This cycle wins in the 1st option.

Example 3, The cycle wins at the 3rd option. The USD/JPY pair makes 3 consecutive green candlesticks => bet the next candlestick red. The 1st option uses $1 – lose. Increase money in the 2nd option to $2.5 – lose. Continue to raise money to $6.5 for the 3rd option – win. This clip is quite long.

In addition, practice counting candlesticks from today. At the candle time periods like 5 minutes or 15 minutes, you will have a habit of choosing trading hours. It’s to ensure a special condition. Never appear a series of candlesticks of the same color in a row.

Important rules when trading in IQ Option

Rule 1: Capital and capital management

Triple candlestick pattern is a sequence of consecutive options. Therefore, you need to have enough money and an appropriate capital management method in IQ Option.

For instance, you deposit $30 to IQ Option. You can divide $30 into 3 cycles into. Each $10 cycle corresponds to the following pattern. The 1st option is $1. The 2nd option is $2.5. And the 3rd one is $6.5.

Do not put all your capital into one cycle. Furthermore, don’t extend a cycle up to 4 or 5 options at once. Because if the market is affected by the sudden news, it will fluctuate in one direction only. The more you bet, the more you lose money. You may even run out of money in your account.

Rule 2: Control emotions when trading in IQ Option

Triple candlestick pattern is easy to make money, especially in the first transactions. However, you need to be calm and never get greedy. Because after a losing or winning streak, you could fall in a psychology trap.

If you lose, you increase money to regain. If you win, you raise money in order to earn more. These are the taboos in options trading, which lead to the mistake that can burn all of your money.

For this reason, training your trading emotions is extremely important in this game. Putting discipline on top is an essential condition to make money sustainably in IQ Option.

Rule 3: Train your skills in IQ Option

All you need to master Triple candlestick pattern is the skill. How to open an option exactly at the time when a new candlestick starts? How to trade continuously in one cycle?

Make your own statistics on the DEMO IQ Option account. Counting each candlestick on the trading interface. Do it at least 2 weeks.

As a consequence, you will know the most suitable time to trade with Triple candlestick pattern in IQ Option. Along with the currency pair which has the highest winning rate.

To summarize

In short, this is a strategy based on the statistical probability of the colors of three previous candlesticks. If the colors of 3 previous candlesticks are red, focus on betting the 4th candlestick green. Otherwise, if the colors of 3 previous candlesticks are green, focus on betting the 4th candlestick red.

With a probability method, you must be the one to make statistics and learn experience for yourself. You can extend it to longer time periods or add some indicators to increase reliability. For example, 3 candlesticks of the same color + the price enters the support/resistance zone => open a reversal option.

Leave a comment below if you find this strategy successful. Love!

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu