![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

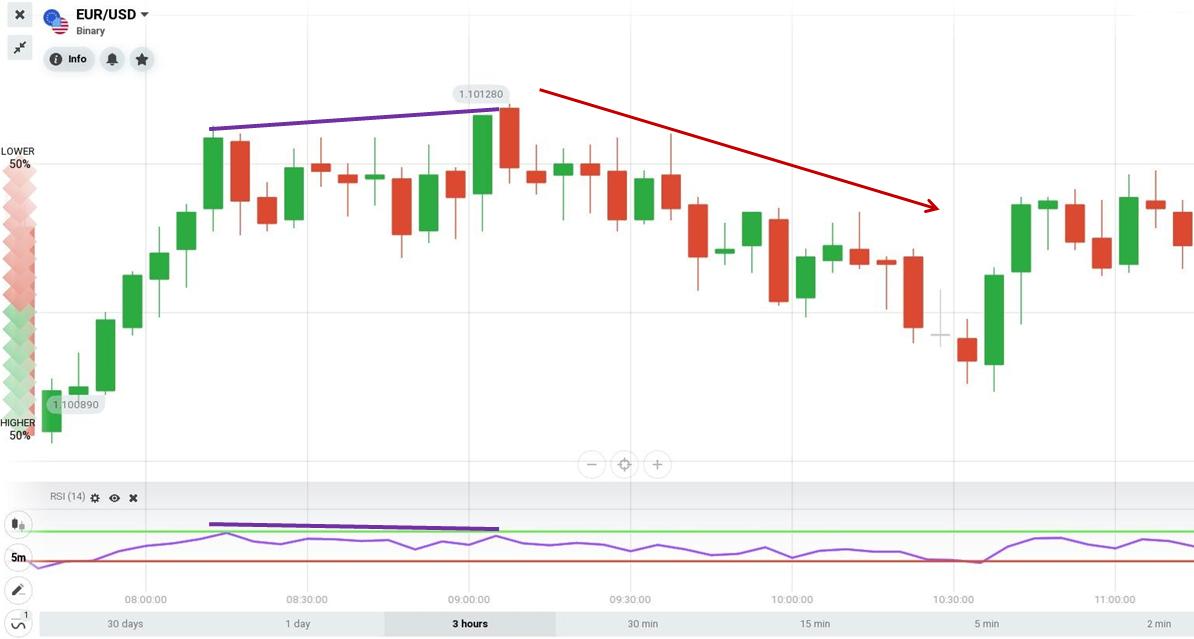

Two of the most effective indicators when trading in IQ Option are RSI and Support/Resistance. Combined with an effective capital management method, it creates a safe trading strategy in IQ Option. In this article, I will guide you in detail on an IQ Option trading strategy. It is a reversal strategy that is most effective when using the combination of RSI indicator and support/resistance.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Trading strategy in IQ Option: RSI combined with resistance/support

How to set up the strategy when combining RSI and levels

– Choose the trading assets including 3 main currency pairs: AUD/USD, USD/JPY, EUR/USD.

– The 5-minute Japanese candlestick chart.

– The expiration time of 15 minutes or above.

– Identify the RSI 14 indicator (Purple), the overbought zone 70 (Green), the oversold zone 30 (Red).

– Identify resistance and support zones

Formula for opening orders

HIGHER = The RSI indicator in the oversold zone + support.

LOWER = The RSI indicator in the overbought zone + resistance.

Open an order according to the strongest divergence of the RSI.

HIGHER = A bullish divergence occurs when the price is falling, but the RSI is up => The price is about to reverse from down to up.

LOWER = A bearish divergence occurs when the price is climbing, but the RSI is down => The price is about to reverse from up to down.

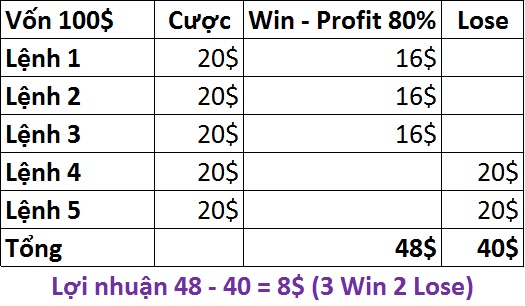

Suitable capital management method

Managing capital with the Classic method is both safe and profitable if the winning rate is over 60%.

Some principles to keep in mind

If you choose reversal trading, enter the trade when the market is sideways or the session is less volatile. Select the following currency pairs:

– EUR/USD in Asian session => Less volatility, consistent with reversal strategy.

– USD/JPY, AUD/USD in European and American sessions => The market usually moves sideways, favorable for reversal trading.

As for diverging trading, you should choose the time when the market tends to increase or decrease. Select the following currency pairs:

– EUR/USD in European and American sessions => The market easily creates trends and divergence.

– USD/JPY, AUD/USD in Asian session => Strong fluctuations, divergence often appears.

Do not open orders consecutively.

Combining the RSI indicator with support/resistance creates a reversal trading strategy at the overbought or oversold points. If the price does not reverse in the overbought zone but continues to rise. Do not open LOWER orders continuously because the possibility of losing is very high. Only open one order when all the conditions are met.

Conversely, if the price does not reverse in the oversold zone and continues to fall, it is advisable not to open HIGHER orders continuously. Only open one order in line with the strategy.

Review on entry points in IQ Option

Reversal trading using the strategy of combining RSI with support/resistance

HIGHER = RSI in the oversold zone + support.

Explanation: The price entered the resistance zone when the RSI crossed the oversold line => The reversal possibility was high => Opened a HIGHER order with the expiration time of 20 minutes.

LOWER = RSI in the overbought zone + resistance.

Open an order using the RSI divergence

HIGHER = The appearance of the bullish divergence.

The trend was down. The price created lower troughs after troughs, but the RSI indicator went up which was against the price => bullish divergence signaled a reversal from down to up => Opened a HIGHER order with an expiration time of 15 minutes.

LOWER = The appearance of the bearish divergence.

The trend was up. The price created higher peaks after peaks, but the RSI indicator went down which was against the price => bearish divergence signaled a reversal from up to down => Opened a LOWER order with an expiration time of 15 minutes.

One last word

In general, this is an extremely effective and flexible IQ Option trading strategy when the market is sideways or in a clear trend. We can find a safe entry point when combining the RSI and Support/Resistance indicators.

We will have detailed articles on orders opened with real accounts using this strategy. Thank you for following up.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu