![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu

This is one of the most popular reversal signals when using Japanese candlesticks. Engulfing candlestick pattern is undoubtedly trusted by traders with a high probability of accuracy. In this article, I will show you how to confirm and trade options in IQ Option with Engulfing candlestick pattern.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

What is Engulfing candlestick pattern?

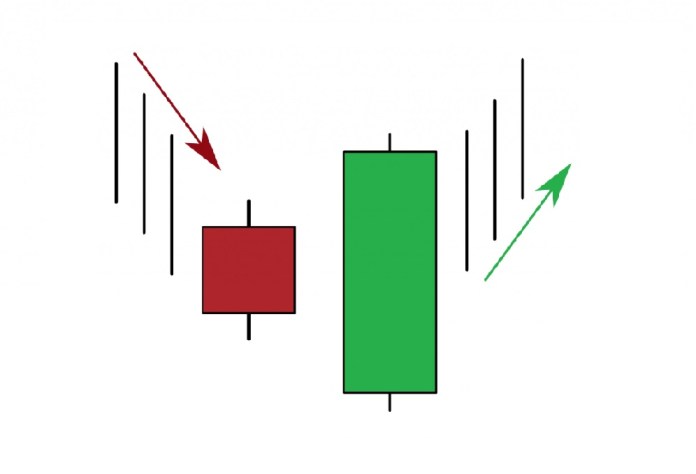

Engulfing candlestick pattern is created by a candlestick that engulfed all previous candlestick price attempts. It also signals a trend reversal. This candlestick is called Engulfing candlestick.

Furthermore, Engulfing candlestick is usually long that covers the entire previous candlestick. The color of Engulfing candlesticks is a signal to forecast the market trend. If it is green, an uptrend is incoming. If it is red, a downtrend is about to come.

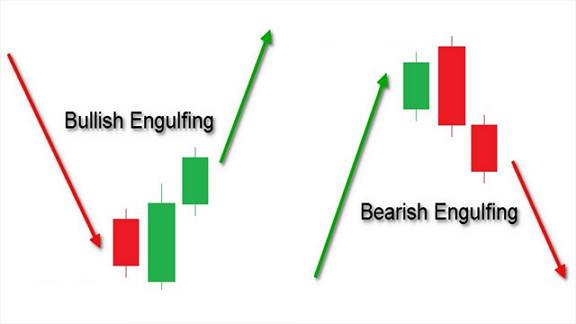

Engulfing candlestick pattern has 2 forms

Bullish Engulfing candlestick

Bullish Engulfing candlestick is a pattern that usually appears at the end of a downtrend. This is a strong bullish candlestick. Bullish Engulfing candlestick covers the whole previous bearish candlestick. Following, the trend is about to reverse from downward to upward.

In general, a basic Bullish Engulfing candlestick pattern consists of 2 candlesticks.

• The first candlestick is a red bullish candlestick.

• The second candlestick is a green one that rises sharply and covers the first candlestick.

A complex Bullish Engulfing candlestick pattern can be formed by more candlesticks. However, it always ends with a green engulfing candlestick increasing sharply and covering the previous candlesticks. In this case, it is a very strong signal for you to open a HIGHER option in IQ Option.

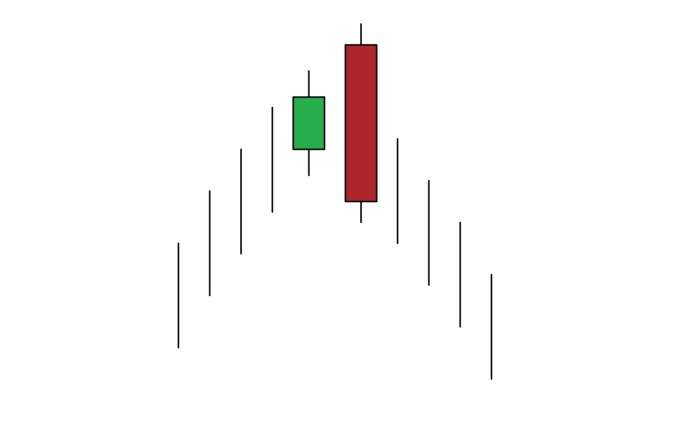

Bearish Engulfing candlestick

Contrary to Bullish Engulfing, Bearish Engulfing candlestick pattern usually appears at the end of an uptrend. The market is expected to decrease in the near future. Moreover, Bearish Engulfing candlestick is a long red candlestick that covers the whole previous green candlestick.

Simple Bearish Engulfing pattern consists of 2 candlesticks.

• The first candlestick is a green bullish candlestick.

• The second candlestick is a strong bearish one (red and long) covering the previous green candlestick.

A complete Bearish Engulfing candlestick pattern can be created by multiple candlesticks. It also ends with a red and long Bearish Engulfing candlestick covering the previous candlesticks. In IQ Option, you can open LOWER options when the Bearish Engulfing pattern appears.

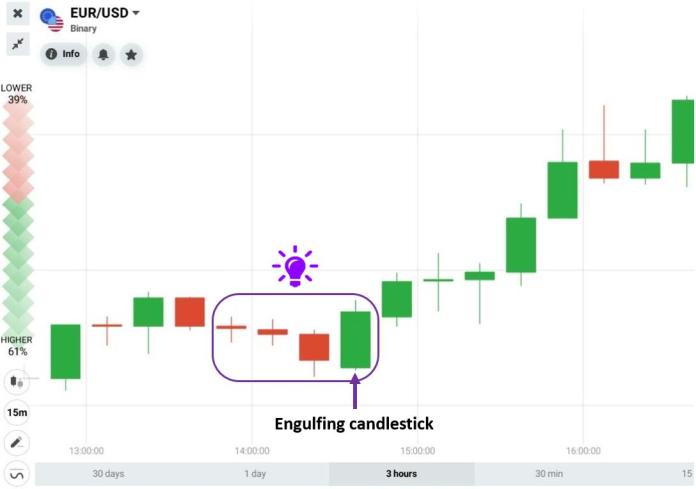

How to trade IQ Option effectively with Engulfing candlestick pattern

This is one of the extremely reliable signals you can use to buy options. Therefore, focus on the color of the Engulfing candlestick. If Engulfing is green, buy HIGHER. And in case it’s red, buy LOWER.

Method 1: Engulfing candlestick pattern combines with Support and resistance

Requirements: Japanese 5-minutes candlestick pattern. In addition, the expiration time is from 10 minutes or more.

Trading method:

HIGHER = Bullish Engulfing + Support.

Explanation: Bullish Engulfing candlestick pattern is a signal that the price will increase. When combining with the support level, it can predict an uptrend precisely. Thus, you can open a HIGHER option.

LOWER = Bearish Engulfing + Resistance.

Method 2: Engulfing candlestick pattern works with SMA indicator

Requirements: Japanese 5-minute candlestick pattern + SMA30 indicator. The expiration time is 15 minutes or more.

Trading method:

HIGHER = The price moves down and touches SMA30 + Bullish Engulfing candlestick pattern.

Explanation: When the price is above SMA30 => It is an uptrend. When it hits SMA30 and creates a Bullish Engulfing candlestick pattern. As a result, there is a high probability that it will rebound to resume the trend. Hence, open HIGHER options.

LOWER = Price moves up and touches SMA30 + Bearish Engulfing candlestick pattern

In summary

Iqtradingpro will have more articles about SMA and Engulfing reversal candlestick pattern strategy. This is a standard trading options technique with trend and signals. If you find this article helpful, please leave a comment below. Thank you so much.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() ไทย

ไทย ![]() العربية

العربية ![]() हिन्दी

हिन्दी ![]() 简体中文

简体中文 ![]() Nederlands

Nederlands ![]() Français

Français ![]() Deutsch

Deutsch ![]() हिन्दी

हिन्दी ![]() Italiano

Italiano ![]() 한국어

한국어 ![]() Melayu

Melayu ![]() Norsk bokmål

Norsk bokmål ![]() Русский

Русский ![]() Español

Español ![]() Svenska

Svenska ![]() Tamil

Tamil ![]() Türkçe

Türkçe ![]() Zulu

Zulu