Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

The Double Doji strategy is simple, yet one of the most reliable setups I have seen in my Forex trading career in IQ Option. I believe it will help many people make a profit by sharing it in the trading community. In this article, I will help you understand it and use it as a tool to make a living.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Where does the Double Doji strategy come from?

I’m sure you’ve heard of Japanese candlestick charts. The shape of the candles can tell us all. Each candle tells a part of the complete story. We just need to learn how to put these parts together.

Doji is one of the most distinctive patterns among Japanese candlesticks. It shows us that the market is in equilibrium when the power of buyers has impacted the power of sellers and neither side has the upper hand. So this is a temporary equilibrium just before a big move occurs.

Now let’s start learning how to use the Double Doji strategy and make money with it

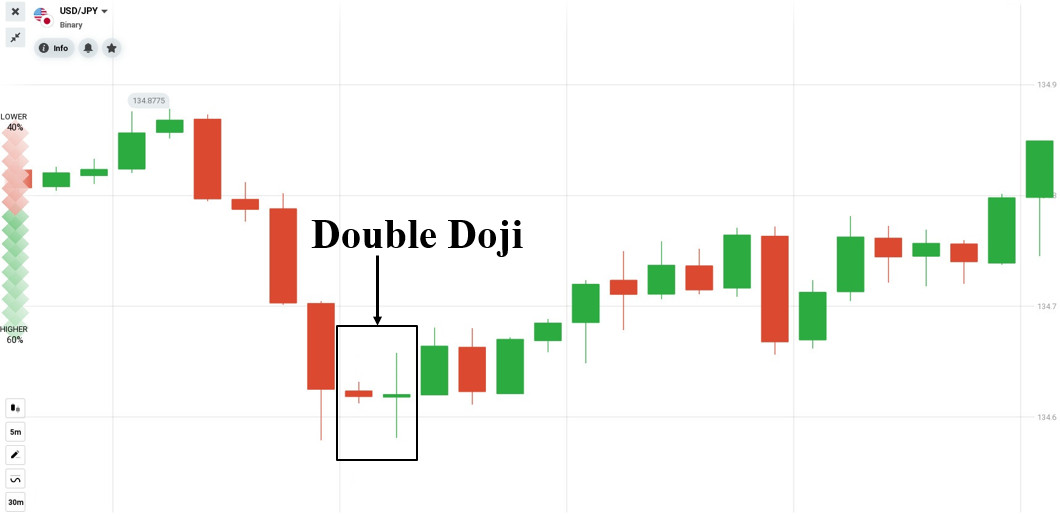

Now imagine what happens when you see two consecutive Doji candles.

This is a war between buyers and sellers. After such a fight, there will be a winner by absolutely overwhelming. In other words, after 2 Dojis in a row, there’s a high chance that it’s an extremely strong bounce.

The first condition for the Double Doji strategy

That is to identify 2 consecutive Doji in turn. Preferably, two Dojis appear after a clear uptrend or downtrend.

Second condition – after detecting two Doji candles

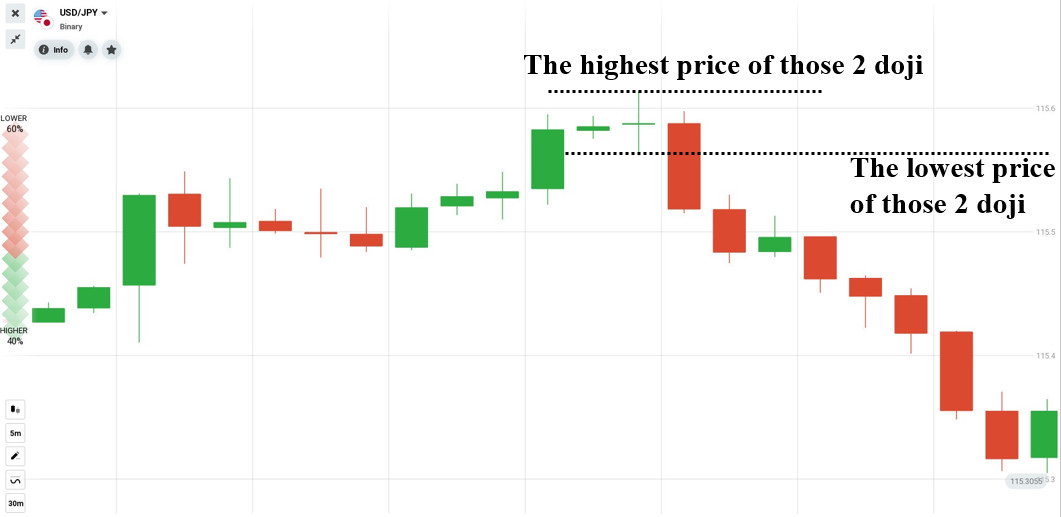

You should mark the border of the two Doji. As you can see in the image below, I have marked the upper and lower bounds of those two Dojis so that it is easy to see what happens next.

Once the lowest high or low of the Doji candle is crossed, there is a move in progress by the market. So it’s the right time for you to take action.

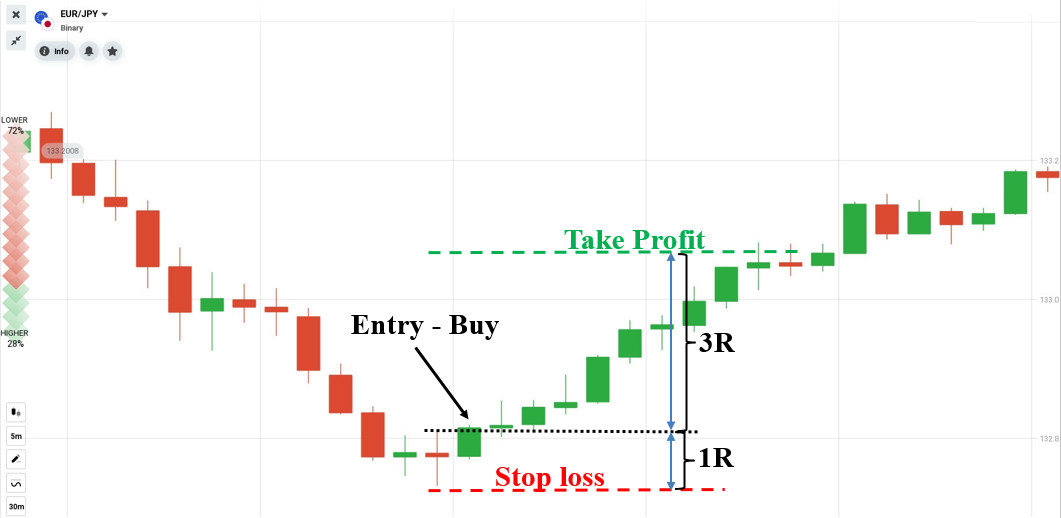

Third condition – Place a reasonable pending order

Place two pending orders at either end of the Doji candle with a larger amplitude than the other one. Two pending orders are prepared for two scenarios. When the market breaks the upper boundary of the Doji, it will trigger a BUY order. And when the market breaks the lower bound, it will trigger a SELL order.

Now you need to set the stop loss of the trade.

For a BUY trade, place a stop-loss below the lowest low of the Doji candle. At the same time, the take-profit is 3 times the distance from entry to stop loss.

For SELL trade, place a stop loss above the highest high of the Doji candle. And take profit must also be 3 times the distance from entry to stop loss, at least 2 times.

Some tips to effectively use this strategy

- It is recommended to use 1-hour, 4-hour, and daily candlestick charts.

- The best currency pairs are those involving USD and crosses of JPY (EUR/JPY, GBP/JPY, AUD/JPY…).

For your convenience, here is a summary of the rules.

- Identify 2 Dojis in a row. It is better when they appear after a clear uptrend or downtrend (minimum 3 green or red candles in a row).

- Mark the upper and lower levels of these Dojis highs and lows.

- Wait for one of the levels to be broken. No need to actually wait, just enter 2 pending orders.

- When one of the orders is filled, cancel the other.

Wish you success with the Double Doji trading strategy in IQ Option.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu