Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

Typically, traders are always engrossed in searching for safe methods to open orders in IQ Option. However, to earn money from IQ Option trading is not simple. In addition to using available indicators, you should learn more about reversal candlestick patterns such as Evening Star pattern, Morning Star, Bullish and Bearish Engulfing, etc.

In this article, I will introduce the combination of the Evening Star reversal candlestick pattern and the resistance. From there, you can build the best trading strategy that offers a steady profit.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

IQ Option trading strategy with Evening Star pattern and Resistance

How to set up this trading strategy

– Choose the trading assets including 3 main currency pairs: AUD/USD, USD/JPY, EUR/USD.

– The 5-minute Japanese candlestick chart.

– The expiration time of 15 minutes or above.

– Standard Evening Star candlestick pattern

– Identify resistance and support zones

Trading formula

The price has previously created a resistance zone. The Evening Star candlestick pattern appears in the resistance zone => The price is about to reverse.

LOWER = Evening Star candlestick pattern + resistance.

The Evening Star candlestick pattern also has variations that consist of small Doji candlestick clusters. These candles show that the price is gradually shrinking in the resistance zone. After that, there is a bearish candlestick, showing that the bullish momentum has exhausted => The price is about to reverse from bullish to bearish.

LOWER = variant of Evening Star candlestick pattern + resistance.

Suitable capital management method

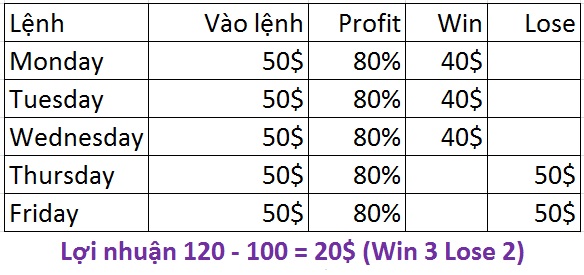

Standard Evening Star candlestick pattern rarely appears within a trading day. However, whenever it appears, it offers high accuracy and safety. To limit continuous orders, only open one order per day when the Evening Star candlestick pattern appears. You can get a 60% win rate every week and make a profit.

Some principles to keep in mind

Do not open orders consecutively.

Open only one order per day. This is why we use flexible and logical capital management methods.

The Evening Star candlestick appears in the resistance zone but without reversing. Besides, there are signs of further increase. To limit opening orders continuously, every time you open an order, shut down the computer and get off the screen => there is no chance to open any more orders. Because when the order is not as you expected, it is easy to lose your temper. Letting the emotions lead will lead to unnecessary losing orders.

Review on entry points in IQ Option

1. Previously, the price created a resistance zone. It then plummeted and broke out of the support. Simultaneously it returned to test the previous resistance. => The candlestick pattern appeared at the resistance zone, which signaled that a bearish reversal was about to begin => Opened a LOWER order with the expiration time of 15 minutes.

Result:

2. The price was on a downtrend and recovered to create a resistance zone => The price rebounded to test the resistance. An Evening Star candlestick appeared right there => The price was likely to reverse => Opened a LOWER order with the expiration time of 15 minutes.

Result:

Summary

Through this article, we can see that the Evening Star candlestick pattern appears to signal the movement of prices from up to down with high accuracy. With a good capital management method, this strategy will bring a steady profit every day. You can test it on a demo account.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu