Three Black Crows candlestick pattern is one of the most reliable reversal signals for LOWER options. It shows extremely safe entry points when trading in IQ Option.

Three Black Crows candlestick pattern appears rarely. But its winning rate is almost 100%. Through this article, we will guide you on how to identify and trade with Three Black Crows reversal candlestick pattern.

What is Three Black Crows candlestick pattern?

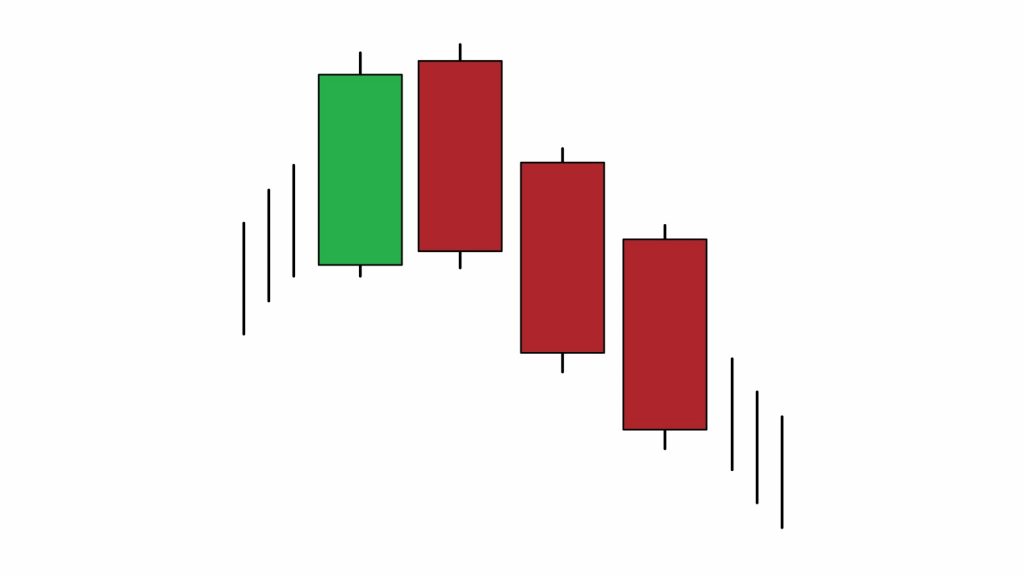

Three Black Crows is a candlestick pattern that signals an upcoming price downtrend. It usually shows up after an uptrend. You can recognize this pattern easily thanks to three consecutive red candlesticks in a row.

Three Black Crows are made of 3 candlesticks.

First candlestick is a bearish red candlestick.

Second candlestick is also a red one. However, its opening price is inside the first candlestick. The closing price is almost equal to the lowest price of the candlestick. It means there is no candlestick shadow or just a short shadow).

Third candlestick is another red candle. It has the same features as the second candlestick.

In IQ Option, Three Black Crows candlestick pattern is a signal for you to buy LOWER options safely and effectively.

How to trade with Three Black Crows candlestick pattern in IQ Option

As mentioned above, Three Black Crows has a high probability of reversing from uptrend to downtrend. Indicators that identify the reversal point such as SMA, RSI, Bollinger Bands are all good when combining with 3 black crows to increase safety when trading.

Guide 1: Three Black Crows candlestick pattern combines with RSI indicator

Requirements: Japanese 5-minute candlestick pattern + RSI indicator. Open LOWER options that have the 15-minute-or-more expiration time.

Trading guide: Three Black Crows + RSI in the overbought zone = LOWER

Explanation: RSI indicator from the overbought zone crosses 70 => The price tends to decrease. When 3 Black Crows candlestick pattern appears => Open a LOWER option.

Guide 2: Three Black Crows candlestick pattern works with SMA30

Requirements: Japanese candlestick pattern + SMA30 indicator. Buy LOWER options with the expiration time that is 15 minutes or more.

Trading guide: Three Black Crows + The price moves down and cuts SMA30 = LOWER.

Explanation: The price cuts SMA30 from above => the trend reverses from upward to downward. The entry signal is Three Black Crows reversal candlestick pattern.

Summary

With reversal candlestick patterns like Three Black Crows, you should customize the expiration time from 15 minutes or more. It’s due to the face that long-time options have a higher winning rate. Besides, your psychology state will be more stable through trading time.

Get started with a Demo account in IQ Option now. Trading demo will definitely help you improve your skills. Please don’t hesitate to leave a comment below. Thank you for your time.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.