Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

When trading Forex in IQ Option, Fakey pattern is one of the most important and powerful trading signals that you need to understand. It helps us determine whether the “big players” have successfully activated the “trap” or not, giving us a good clue for the next price behavior. Let’s read this article to learn more useful knowledge about the financial market.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

What is the Fakey Pattern?

Fakey pattern is also known by many different names such as bull trap, bear trap, price trap pattern… In general, it is one of the price action candlestick patterns.

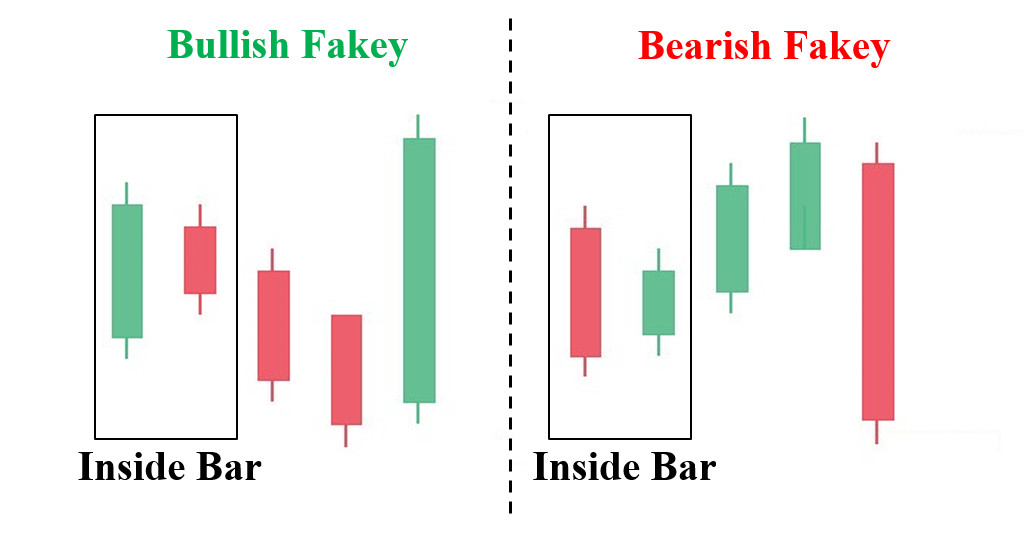

Fakey is simply a combination of an Inside Bar and a false breakout.

Fakey’s structure includes:

- An Inside bar pattern (1 Mother bar and 1 inside bar)

- An inside bar breakout candle

- The final is a reversal candle from the previous breakout candle. After Fakey is formed, the market will move in the direction of the reversal candle.

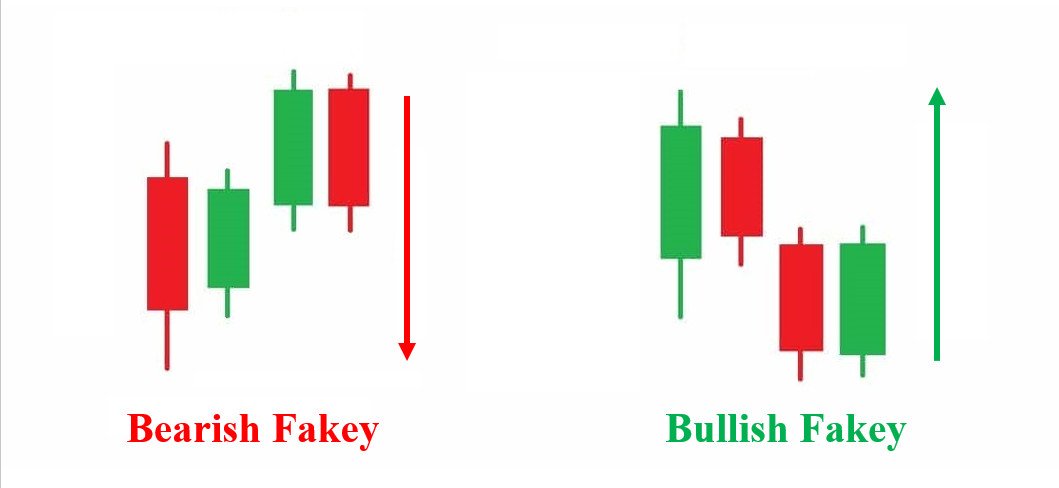

Basic Fakey patterns

The first and important point with Fakey is that the pattern is only applicable for trend trading or sideways trading strategy. As it shows a false breakout of the price after the inside bar pattern. There are two basic types of Fakey.

Fakey with False Breakout

A basic Fakey pattern with a False Breakout cluster will have the following form.

- Inside Bar candlestick pattern will form first.

- This is followed by a candlestick that breaks out of the range of the Inside Bar.

- But soon the price will be pulled back to reject the previous candle. And the price will continue to progress in this opposite direction.

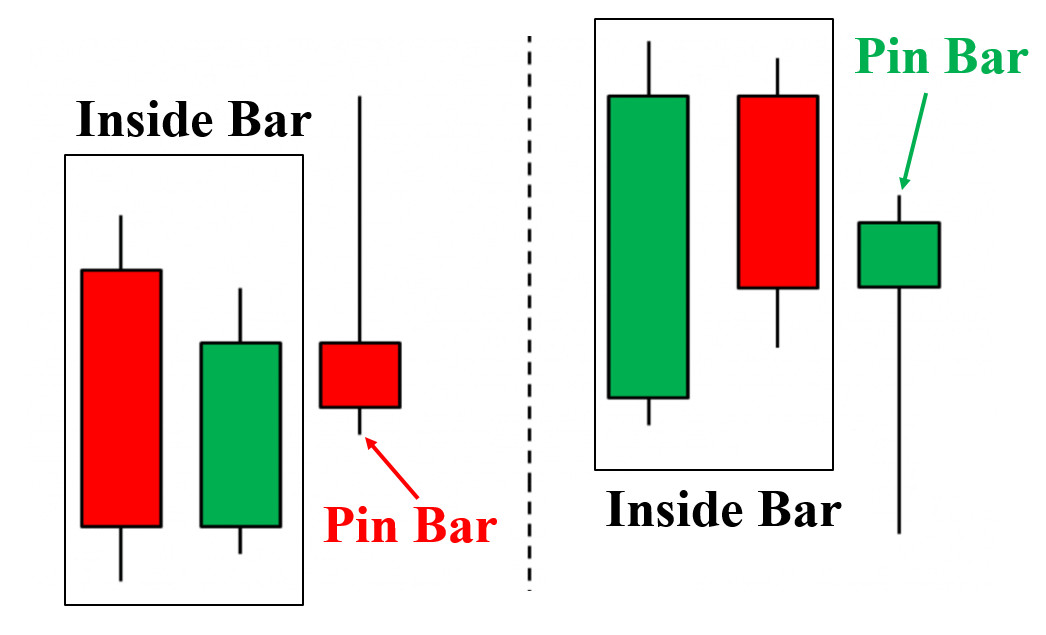

Fakey with Pin Bar

A Fakey pattern with Pin Bar looks like this.

- The Inside Bar cluster will form first.

- After that, the next candle will be a pin bar with the shadow breaking out of the range of the mother candle of the Inside Bar cluster. And the closing price of this candle is finally within the range of the Inside Bar.

- This pattern is very recognizable for new traders using Fakey candles. Because it only has an Inside Bar cluster and a simple Pin Bar candlestick.

Market sentiment in the Fakey pattern

I will give an example of the sentiment in the case of a bearish Fakey candle.

First, the “big players” will place buy and sell orders with the lowest frequency and volume to create an Inside Bar candlestick pattern. They will then buy to form a bullish Inside Bar pattern and now traders think the market will work in this pattern. And the price will go higher to prepare for the next short sale of these big players to achieve optimal profits.

At this point, traders will place a BUY order and place a stop loss just below the Inside Bar as usual.

But, shortly after, the “big players” will place a large short order, causing the price to reverse downward and wipe out the trader’s stop loss. When the stop loss is triggered, the trader’s mentality will shift from a BUY order to a SELL order. With a large SELL volume, it will create strong selling pressure, pushing the price down deeper.

How to trade with Fakey pattern

Trading method with Fakey is not too complicated. Traders need a little sensitivity and discipline to have a high probability of success. Here are some steps when trading with Fakey that investors need to grasp.

Step 1: Identify the market trend.

First, traders need to determine if the market is in an up/downtrend or a sideways market phase. Next, identify key price areas that are likely to reverse such as resistance and support so that when a Fakey appears, you will have the opportunity to enter orders.

Step 2: Place a trading order.

In the case of the Fakey pattern is formed by a pin bar candlestick, you can buy or sell at the price above the top of the pin bar. Or wait for the price to break out of the Mother bar like the example below.

If there is a Fakey pattern with False Breakout, you can enter an order when the price breaks through the top or bottom of the Mother Bar candle.

Step 3: Set stop loss, take profit

– Stop Loss: Place at the top or bottom of the Mother Bar candle in case the market won’t move as expected.

– Take Profit: Regardless of the trading method, you should set the take-profit according to the ratio R/R (risk/reward) of 1:2. That is, the distance from the entry point to the stop loss level must be 1/2 the distance from the entry point to the take profit level of the transaction.

Summary

By presenting the most accurate and general knowledge about the Fakey candlestick pattern, the article once again confirms the effectiveness that Fakey brings to traders.

For price action traders in particular and investors in general, it is extremely necessary to understand deeply and know how to apply the Fakey pattern to trading. It is like a warning signal that helps traders not to be “trapped” by false reversals in the market.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu