Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

To make a profit in the financial market, you have to do one thing: “buy low sell high”. This means that you either buy low and sell high or buy high and sell at even a higher price. In order to do that, it requires traders to determine when the trend ends or whether it will continue to make higher highs or lower lows. In this article, I will share with you a precise top and bottom fishing strategy using the Bollinger Bands indicator and the Inside Bar candlestick.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

The effect of the Bollinger Bands indicator in bottom/top fishing

Bollinger Bands consists of 3 basic components as follows:

- Moving Average: Use the default MA over 20 sessions; SMA (20)

- Upper Band: has a standard deviation of 2, calculated from 20-session price data. It stays above the moving average – SMA (20).

- Lower Band: has a standard deviation of 2 and is below the SMA (20).

Based on that structure, traders use it to determine effective reversal points. Most of the time, the price has an active range between the upper and lower bands of the Bollinger Bands. This gives a way to determine the trough when the price starts to close a candle below the lower band, or the peak of an asset when the price has left the upper band.

You can read the chart and see that when the price hits or goes beyond the bands, there can be seen as a bottom or a top. However, in fact, you cannot fully believe in this, because during a strong trend, the price can completely overcome the bands for a long period of time. Therefore, you need to observe additional signals to confirm whether this momentum is strong or weak.

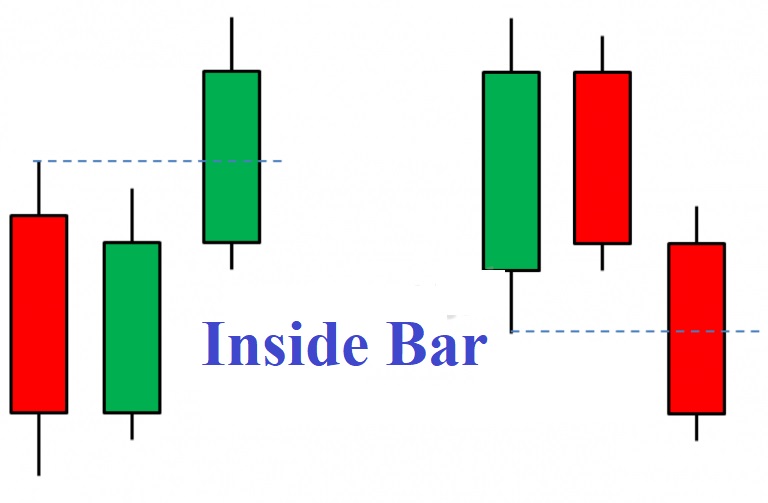

The Inside Bar candlestick – an essential condition for Bollinger Bands

Bollinger Bands is not an independent trading system, It is simply an indicator designed to provide traders with information regarding price movements. Therefore, it is necessary to have more confirmation conditions to increase the security of each order. Then, we need to add a filter such as the Inside Bar candlestick to come up with a perfect trading strategy.

We will enter the market when the price touches the upper or lower bands of the Bollinger Bands indicator. However, we will do it only if the next candle does not touch the previous highest peak or lowest trough.

The Inside Bar candlestick will show that the momentum of the market has weakened and the chance of a reversal will be higher. Therefore, the combination of the Bollinger Bands indicator and the Inside Bar candlestick helps you to determine the top or bottom much more accurately. Now, we will go into the details of the strategy.

Principles for the trading strategy using Bollinger Bands in combination with the Inside Bar candlestick

The setup conditions are as follows:

Time frames: should be 5 minutes or more.

Currency pairs: any.

Technical indicators: the default Bollinger Bands in IQ Option.

How to open an order

Open a HIGHER order when: the closing price of the candle is out of the lower band, we will wait to see if the next candle will break out of the highest and lowest prices of the out-of-lower-band candlestick. If not, then we are qualified. The second candle is considered a signal candle. We will place a HIGHER order as soon as the third candlestick closes above the highest price of the first candle (Inside Bar).

Open a LOWER order when: the closing price is out of the upper band, we will wait to see if the next candle will break out of the highest and lowest prices of the out-of-upper-band candlestick. If not, 2 conditions to enter the order have been met. And the second candle is considered a signal candle. Open a LOWER order when the third candle closes below the lowest price of the first candle (Inside Bar).

Be patient in exchange for a profit

All strategies require a nice entry point. To get it, you need to pay your time, aka exchange time for a profit. However, the waiting time is extremely dangerous for inexperienced traders. It will make you feel extremely uncomfortable and urge you to “do something” which will lead to your loss.

In my opinion, most trading strategies offer a very high probability of winning. It will happen if only the investors adhere to the rules and discipline strictly before opening an order. And it is surprising that most of the time when it comes to applying, the situation of prolonged loss occurs. The biggest cause of that situation is often because you are not patient enough to wait for an entry point that fully meets the conditions set out by the strategy.

To overcome the above stupid mistakes, you need to stick to the set-out principles. Place orders when and only when they have met the requirements of the trading strategy.

To conclude

If you have just read through this strategy and think you will become a money-making master in IQ Option, it is an illusion. Any strategy needs to go through a real-time battle to learn. And a Demo account will help you do this in the best way.

Therefore, I advise you not to rush into the market to make money right away. Just continue to learn and statisticize the probability of profit in the most detail. When the actual situation shows positive results which are profitable for many consecutive months, then it is time to think about making a profit.

Register IQ Option and Get Free $10,000 Risk warning: Your capital might be at risk.

Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu