English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

The stability and development of a country are all protected by brave soldiers. They stop the conspiracy of terrorists who want to sabotage a nation’s economy. In trading, the Three White Soldiers candlestick pattern represents a rapid growth that eliminates existing bearish momentum.

When soldiers appear, there will be opportunities to make money for the traders. To know how to make a profit, together with iqtradingpro.com, we will go into detailed analysis.

Registreer IQ Option en ontvang gratis $10.000 Risk warning: Your capital might be at risk.

What is Three White Soldiers candlestick pattern?

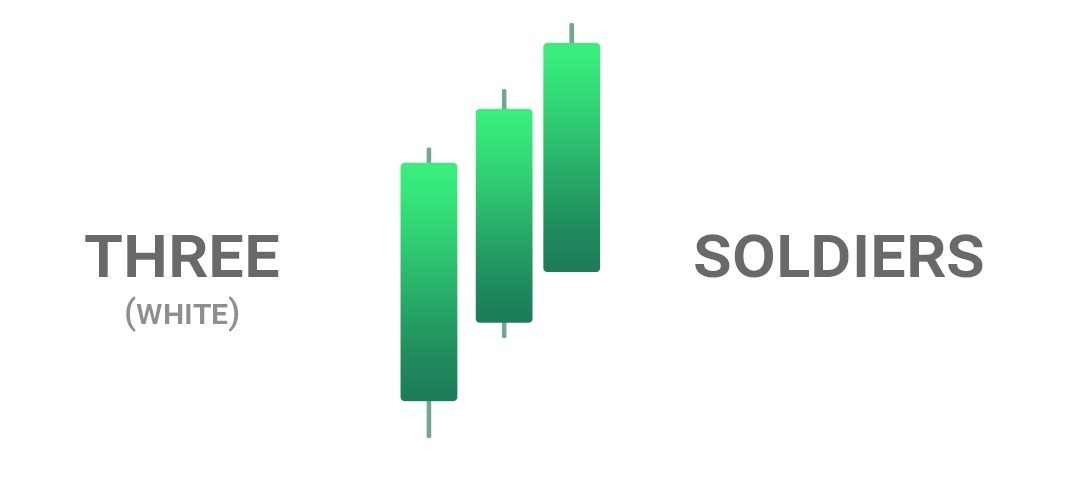

Three White Soldiers is a 3-candle cluster pattern that signals an increase in price. They often appear in a downtrend and warn of a possible reversal to an uptrend. Candles of this pattern have an opening price inside the body of the previous one and have a closing price close to its own highest price.

How to identify a Three White Soldiers candlestick pattern

Three White Soldiers is a visual pattern that is easy to identify with the naked eye. However, you should note the following characteristics to identify.

– Appear during a downtrend or in a pullback of an uptrend.

– The three candles in the pattern must all be bullish and have a long body, short shadow.

– The opening price of the next candle should be either above or equal to the closing price of the previous candle.

– This pattern shows a bearish to bullish trend reversal signal.

Notes: The original 3 White Soldiers candlestick pattern requires the opening price of the following candle to be above the closing price of the previous one (i.e. a gap). However, in high-liquidity markets, there is no need for a gap at the opening.

Meaning of 3 White Soldiers candlestick patterns

The Three White Soldiers candlestick pattern shows a drastic change in market sentiment. For stocks, commodities, and currency pairs, it creates a strong uptrend on the chart

when you see a candle with a short tail or without an upper tail. We can understand that the bulls are trying to keep the closing price at the highest price. And when those 3 candles appear in a row, it will form a strong bullish pattern in the future.

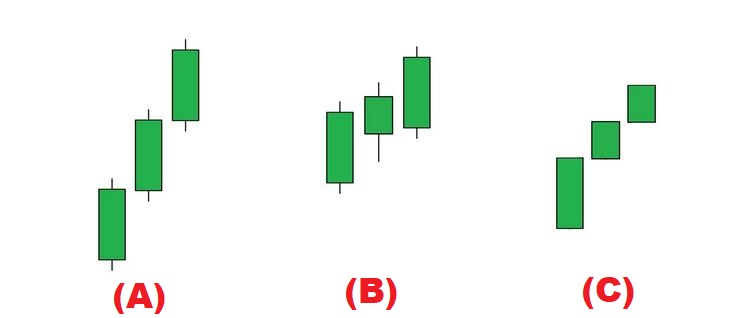

Common Three White Soldiers candlestick patterns

In the Japanese candlestick chart, there are many variations of the Three White Soldiers pattern that you need to know. They all give bullish signals but are fundamentally different in appearance.

(A) is a pattern without strong volatility where the previous candle’s closing price is the same as the next one.

(B) is a standard pattern when the following candles’ opening prices are below the closing prices of the previous candles.

(C) is a pattern in which all candles are Marubozu candlesticks with the closing price at the highest price. The probability of prices continuing to rise is very high.

How to manage capital with this strategy

Capital is money. Specifically, it is the amount you intend to invest in. Capital management is effective controlling of your capital expenditures. From there, you can make the best trading decisions for your long-term investment development plan.

Investors manage capital by dividing their trading balance to diversify their portfolio so that they can manage risks and control different levels of risk. At the same time, they can optimize profits on each transaction.

If you run out of capital before you find an effective trading system, you cannot continue to “pay the tuition” to the market to continue on this difficult path. Hedge fund manager Larry Hite once said “If you don’t bet, you can’t win. But if you lose all your capital, you cannot continue to bet.”.

2% of the total capital for each investment deems to be the best risk ratio in trading. If capital management is at 2% for a losing trade, with 10 consecutive losing trades, you still have up to 80% capital to start over. Of course, after readjusting their trading systems,

traders need not be too concerned about a losing trade. If there are many persistent losses, what you need to worry about is not about the lost money but about your trading system. An efficient trading system coupled with the discipline in capital management will generate stable returns over time.

How to trade with this pattern in IQ Option

The Three White Soldiers candlestick pattern is the start of an upcoming bull run. It is used by investors as an entry point. This deems to be the best opportunity to make money from the market that you should not ignore.

Traders should be aware that when prices are pushed up quickly, overbought can occur. For example, the relative strength index (RSI) may have moved above 70 (overbought). Care should be taken when opening UP orders there.

The most important thing to support the formation of the Three White Soldier pattern is the trading volume. For whatever pattern takes place with low trading volume, this is just the action of a small number of people in the market to participate in trading this asset, not the majority.

Combined with RSI indicator

RSI is a technical analysis indicator that helps to find reversals when prices are overbought or oversold. With the Three White Soldiers candlestick pattern, we are only interested in the oversold zone. Right there, the probability of a reversal from decreasing to increasing is highest and safest.

Conditions: A 5-minute Japanese candlestick chart. Set up an RSI indicator in IQ Option. Open orders with an expiration time of 15 minutes or above.

Open an UP order when: A Three White Soldiers candlestick pattern appears at the oversold zone of the RSI indicator.

Explanation: When the price enters the oversold zone, the market has priced the asset below its real value. There, the probability of a reversal from decreasing to increasing is the highest. Open an UP order when the Three White Soldiers candlestick pattern appears in the oversold zone.

Combine with support zone

The support zone is a zone where the price reaches when the asset’s price falls to the expected bottom (or support level) in technical analysis. It is a zone where prices cannot easily fall below.

Conditions: A 5-minute Japanese candlestick chart. Open orders with an expiration time of 15 minutes or above.

Open an UP order when: The Three White Soldiers candlestick pattern hits the support zone.

Explanation: When prices enter the support zone, there must be a very strong buying force from traders. This is the price range that most of them consider the best to buy. Open an UP order when the Three White Soldiers candlestick pattern forms at the support zone. There, your odds of winning are highest.

Combined with Weis Wave Volume indicator

With the participation of the majority, the Weis Wave Volume (WWV) technical indicator will recognize the trading volume. It provides certain security when opening trendy orders.

Conditions: A 5-minute Japanese candlestick chart. Open orders with an expiration time of 15 minutes or above.

Open an UP order when: The formation of a Three White Soldiers candlestick pattern and the WWV indicator signal that large trading volume is in progress.

Explanation: The Three White Soldiers candlestick pattern alone is not able to confirm the next trend. Thanks to the volume indicator, traders can observe the inflow of money. From there, you can see that the crowd is participating in buying transactions, creating an uptrend. Open an up order when the Three White Soldiers candlestick pattern forms and the WWV indicator signals high trading volume.

In one word

The Three White Soldiers candlestick pattern deems to be the most prestigious reversal pattern in the Japanese candlestick chart. A lot of traders have made money by applying it to trading in IQ Option. However, to make a profit from trading, you must first understand the trading strategy. Practice on a Demo account thoroughly before plunging into risky markets.

There will be a review of how to trade with the Three White Soldiers candlestick pattern with a Real account. Stay tuned. I wish you successful transactions.

Registreer IQ Option en ontvang gratis $10.000 Risk warning: Your capital might be at risk.

English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu