English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

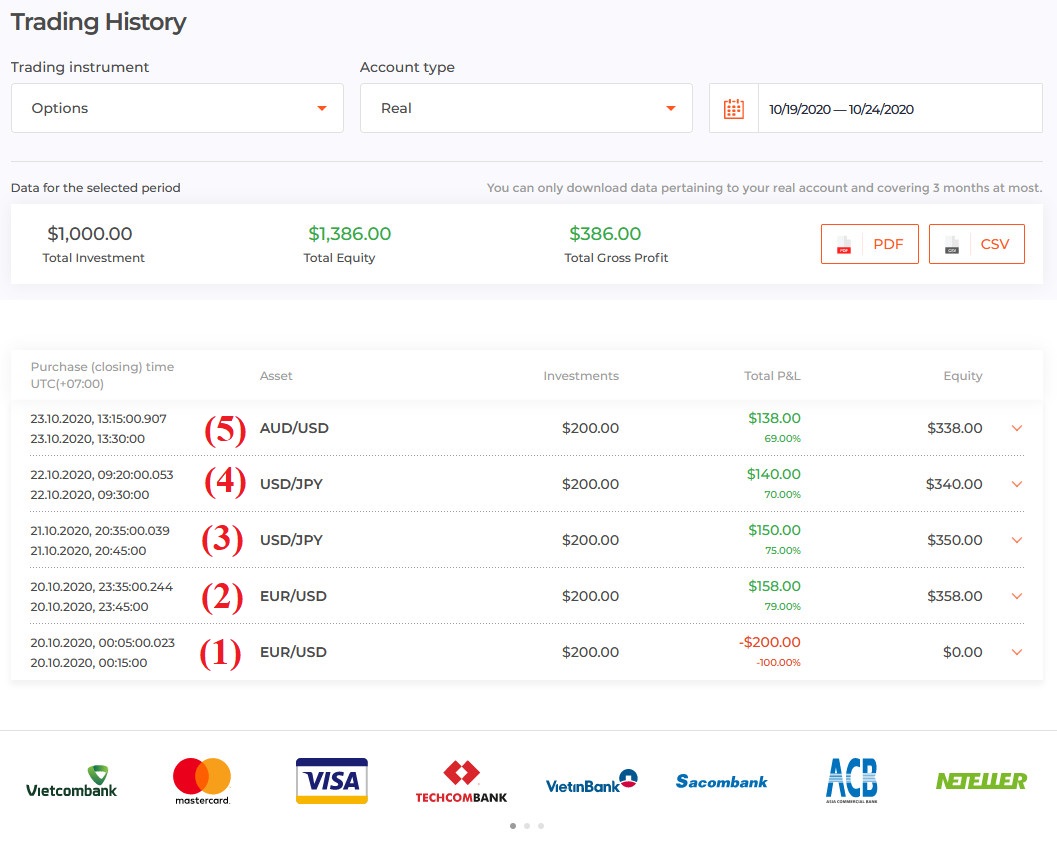

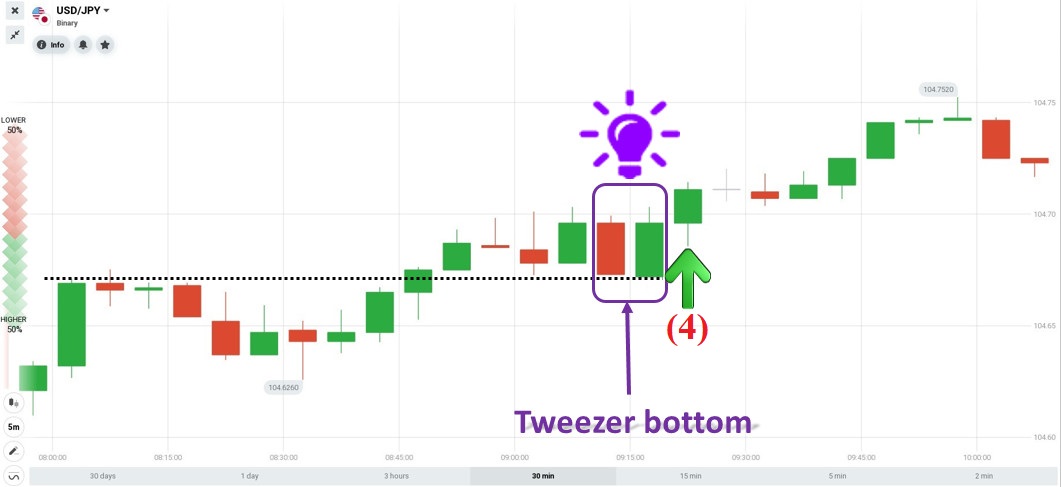

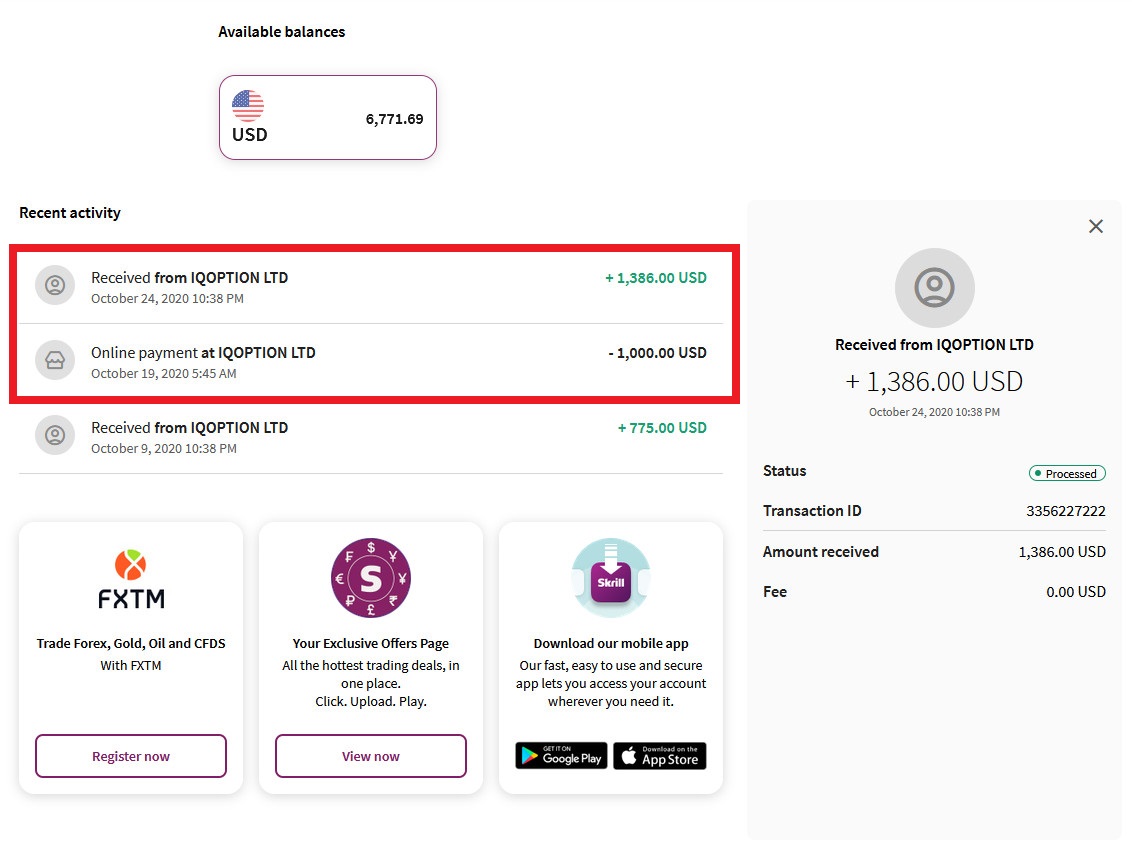

The Japanese candlestick pattern has a long history which is used by Japanese rice traders. These days, they are used to predict the direction of price movements in financial markets. With its high accuracy and easy recognition, experienced traders always take it as a reliable signal to open orders. This review will show you how simple it is to apply the Tweezer candlestick pattern to earn $386 in IQ Option.

IQ Option 등록하고 $10,000를 무료로 받으세요 Risk warning: Your capital might be at risk.

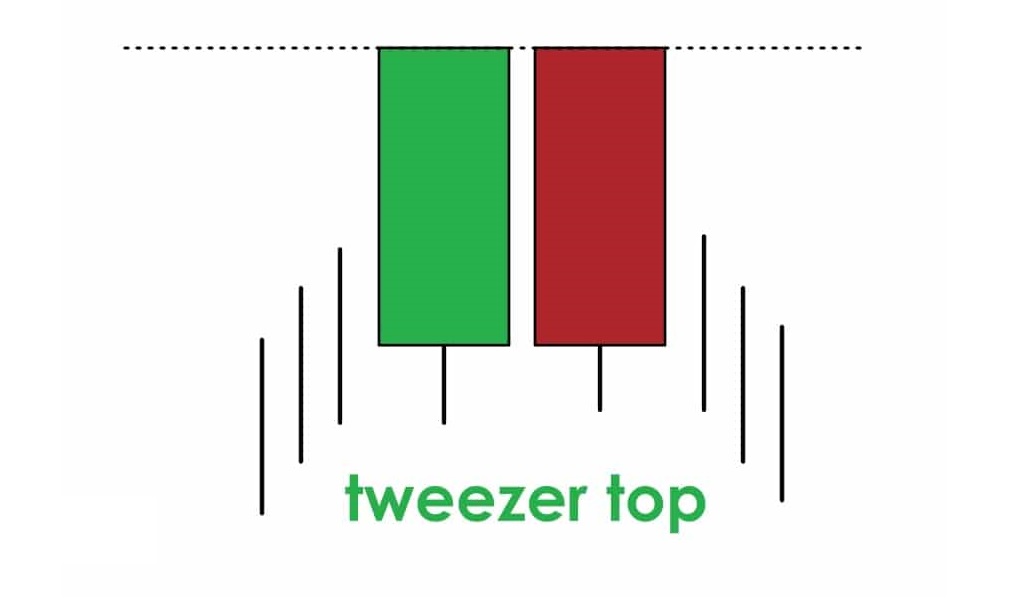

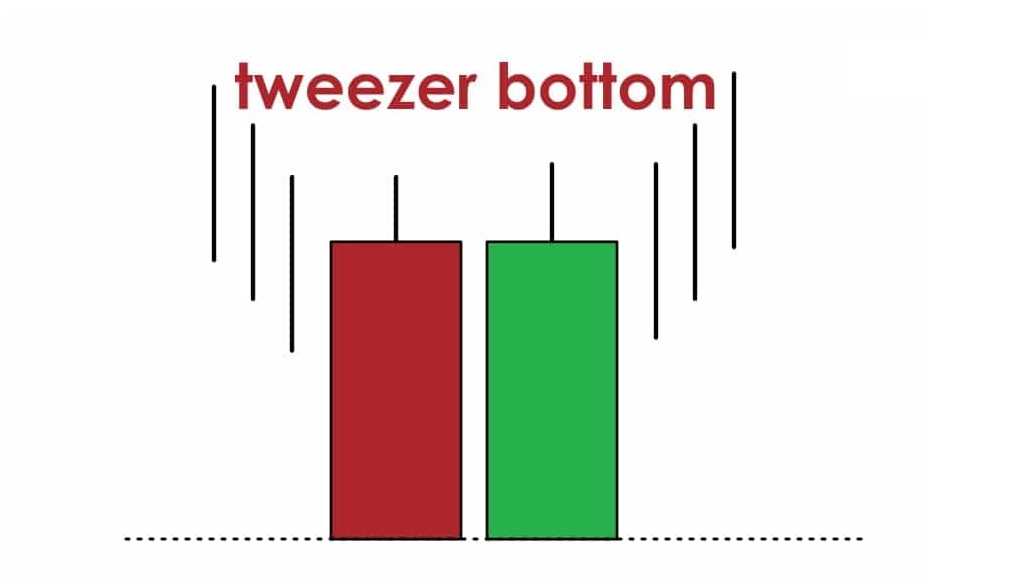

Choose the right trend for the Tweezer candlestick pattern (tweezer top, tweezer bottom, or railroad track)

Don’t take the trend lightly. It is one of the most important factors that will help you win. The trend identification plus signals from the candlestick pattern provide a good entry point.

– Uptrend + Tweezer Top => The price is about to reverse from bullish to bearish.

– Downtrend + Tweezer Bottom => The price is about to reverse from bearish to bullish.

Markets without trends will cause your predictions to be inaccurate. So I will not open orders when the market is sideways.

How to open an order with the Tweezer candlestick pattern

Candlestick patterns all need a suitable trend to be effective. It is like a boost to increase your odds of winning. Trends are gifts given by “Mr. Market”. Accept those gifts because inside them is your profit.

Open a HIGHER order when: The Tweezer Bottom candlestick pattern appears in a downtrend.

Open a LOWER order when: The Tweezer Top candlestick pattern appears in an uptrend.

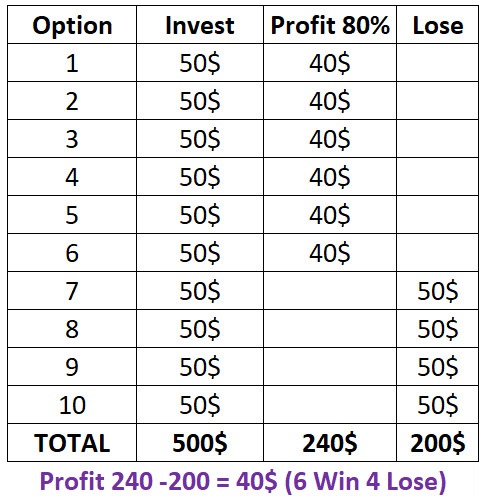

Apply capital management to leverage the power of probability

The financial game is likened to by many traders as a game of probability. You can choose the entry point with the highest probability of winning when you are a patient person. On the contrary, you will face high risks when you follow no principle and discipline.

Gone are the days of investment-multiplying orders (Martingale) that give your account immortality. In fact, those are the classic lies that make newbies think they will never lose.

Then one day, the market will prove that nothing is immortal over time. As a result, you will receive a valuable lesson paid for by the money in your account.

Right now, we need security plus the power of probability to make sure profits. And the Classic capital management method (balanced investment) will give you that.

With the odds of random increases or decreases, the odds of winning or losing are within 50%. Then, adding a few indicators along with good discipline will give a win rate above 60%.

Review on entry points with the Tweezer candlestick pattern

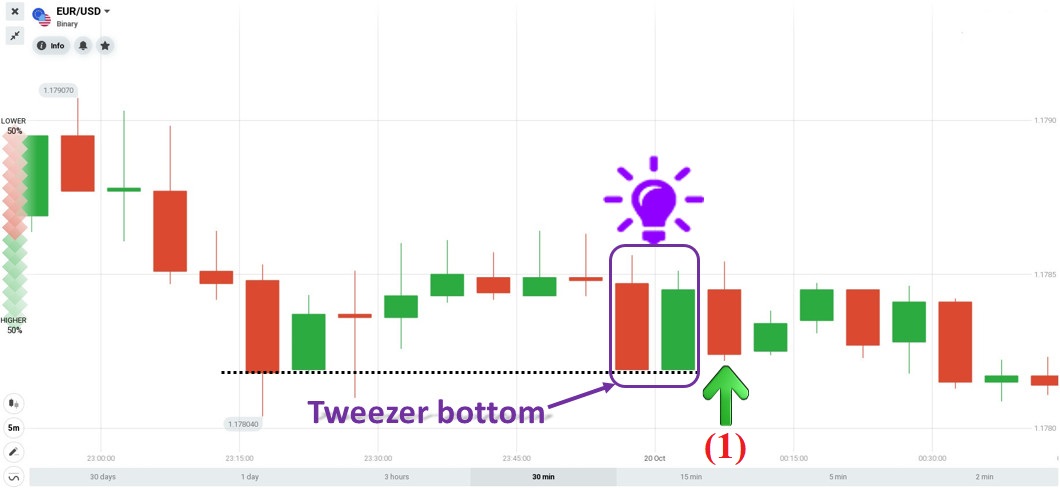

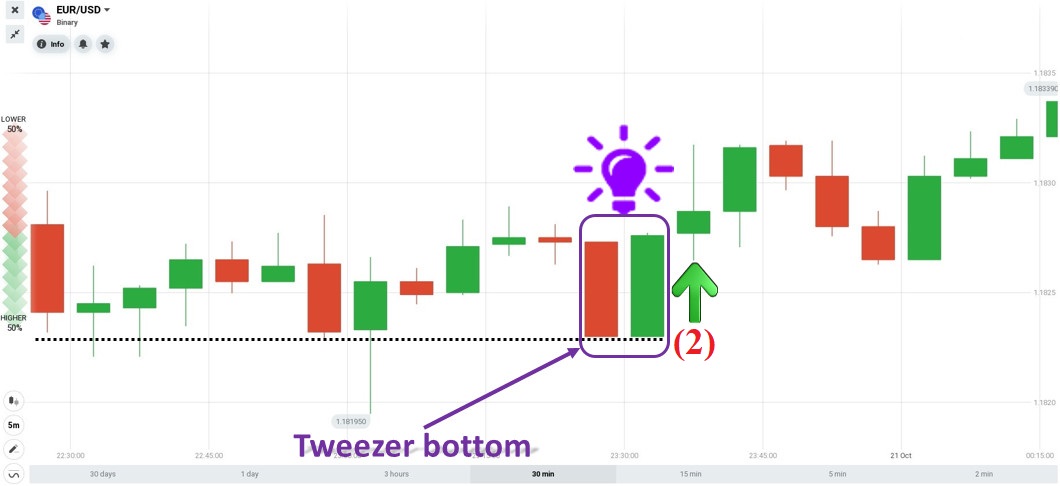

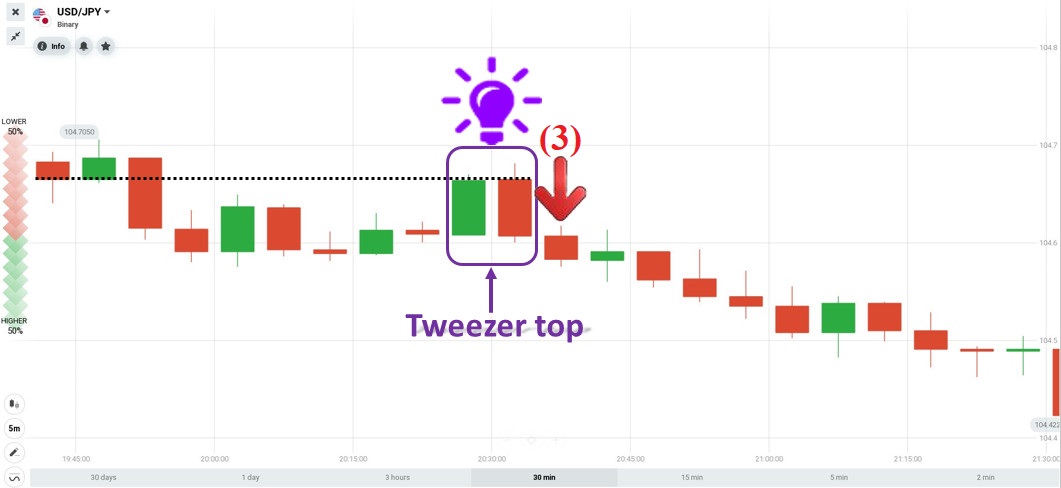

Conditions: A 5-minute Japanese candlestick chart. Open orders with an expiration time of 10 minutes to 25 minutes.

Currency pairs: USD/JPY, EUR/USD, AUD/USD.

1st order: On October 20, the EUR/USD pair formed a Tweezer Bottom candlestick pattern at the support zone. Opened a HIGHER order with an expiration time of 10 minutes for $200 => I lost.

2nd order: On October 20, also with the EUR/USD pair, the Tweezer Bottom pattern appeared at the support zone. Opened a HIGHER order with an expiration time of 10 minutes => I won.

3rd order: On October 21, with the USD/JPY, at the resistance zone, a Tweezer Top candlestick pattern appeared. Opened a LOWER order with an expiration time of 10 minutes => I won.

4th order: On October 22, with the USD/JPY pair in an uptrend, the Tweezer Bottom candlestick pattern appeared at the support zone. Placed a HIGHER order with an expiration time of 10 minutes => I won.

5th order: On October 23, with the AUD/USD pair, a Tweezer bottom pattern appeared. Before that, there had been a Bullish Pin Bar candle with a long lower tail, showing that the bearish force had weakened. Opened a HIGHER order with an expiration time of 15 minutes => I won.

In conclusion

Be cold-blooded hunters with deadly shots that quickly destroy the prey. Don’t think about what to do with the trophies before you start your hunt. Just focus 100% on the process, the rewards will come when you do your job well.

Now you have one more strategy to make money from IQ Option with the Tweezer candlestick pattern. Add it to your test list before bringing it into action. It is up to you if you can convert a recipe into a chicken that lays golden eggs. Wish you success.

IQ Option 등록하고 $10,000를 무료로 받으세요 Risk warning: Your capital might be at risk.

English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu