English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

If you are an options trader in IQ Option, I am sure that you once were a beginner with the thought of trying to « sift for gold » to have a method of an extremely high win rate (must be over 80%) for yourself. However, once you’ve gone through that stage, you feel that you are « stupid » thinking like that. It is simply because there is no way you can achieve such an amazing win rate. And there are many other myths that make new traders fail to apply in practice which will be shared through this article.

Enregistrez IQ Option et obtenez 10000$ gratuits Risk warning: Your capital might be at risk.

Using the Sentiment indicator to decide on trading orders will easily lead to failure

Sentiment can be considered as a tool to measure trading sentiment between the buying and selling sides. It is shown on the left-hand side of the screen for traders to follow. They then can make a decision based on the majority of HIGHER or LOWER. That is, for an asset, when the buying side opens many orders, there is a high probability that the price will rise and vice versa.

It is true that when looking at this tool, everyone will love it because it helps you to get trading « advice » from many other traders. Some traders even use only this tool to open orders. This is a very negative trading strategy when listening to the crowd. They don’t know that crowds often make emotional decisions that lead to the loss of money.

I can say that this tool has almost no analytical value at the moment. This is because Sentiment’s data cannot cover the entire market. It is just data that the platform collects from the group of people trading at the platform. Sentiment only shows the decisions of other traders. It is not logical.

In my opinion, using the Sentiment indicator to decide on an order is no different than tossing a coin. With a 50-50 win rate, it is very difficult for you to make a profit. Although it is quite simple to apply, in fact, the efficiency is not high.

An IQ Option beginner often uses overly complex trading strategies

If you walk around the options trading forums, the things that will catch your eye will be billions of instructions on how to trade ranging from simple to complex. As they are beginners, most of them will choose complex strategies. With the thought that it will be better than simple things, they believe it will bring the profits that they want.

Basically, all traders at first think that complexity is the key to making money. However, things are completely opposite when you apply them in real combat. I have sincere advice to you that you can use whatever method that you like and feel suitable. Whether it is simple or complex will not matter when you want to learn to the end.

However, the quintessence comes from simplicity. If possible, take the time to streamline your strategy and keep the most essentials. Give it flexibility in a volatile market. Keep streamlining it until everything is as compact and efficient as possible.

Extending expiration time to increase your odds of winning

Extending expiration time to reduce psychological pressure, I accept that view. However, it is very wrong to believe that trading with a long expiration time can increase the winning rate. The purpose of prolonging the expiration time is to limit negative emotions to burst out.

With small time frames, it’s impossible to control your feelings as a beginner. Therefore, longer doesn’t mean it is easier to win, but it gives you a better psychological preparation.

For example, your trading strategy is for the 1-minute expiration time. Because you want to increase the win rate, you set it to 5 minutes as you always lose on the 1-minute time frame.

Extending the expiration time should be one of the trading strategy principles. Otherwise, prolonging the expiration time not only does not increase your odds of winning but also risks more losses. This is because it is the act of breaking transaction principles.

Trading with a high payout rate (more than 90%) has a high risk of failure

In addition to the other outstanding advantages, options trading has a disadvantage of 100% loss if you lose. However, it is unfair to gain only 70-85% when you win. Therefore, new traders always find times to trade with high payouts to avoid that disadvantage. And it’s good to have a payout rate of above 90% which is quite attractive for beginners. What a rare and promising opportunity to boost profitability.

However, in reality, such high payout transactions often come with high risks. For example, the timing of the news release or the OTC market has large fluctuations in trading volume. That is, the platform will push the payout rate higher for high-risk entry signals. Thus, a high payout rate also comes with great risks, not as beneficial as you think.

The payout rate that I can accept when trading options is around 75-85%. That is the level I feel comfortable with investing in this type of trading. You can use the power of probability by raising your win rate to 60%. Surely, you will have stable profits in the long term.

A simple but effective trading strategy in IQ Option for beginners

I don’t mean to brag about how I make money in IQ Option. If you are a familiar reader of this blog, you will know how I make money. Below is a link that describes the strategy in details for you to find out:

T.L.S financial trading strategy in IQ Option.

What about a strategy that you practice over and over again thousands of times? That will make you understand it better than yourself. Utilize its advantages to seek profits. Limit its disadvantages to avoid risks occurring in the trading process. It is not an exaggeration to say that I am an « expert » in using the T.L.S strategy.

Have you ever heard the phrase « experience is better than cleverness »? If you have a good strategy but you can’t understand it, you will be the loser. But once you are all too familiar with a single trading strategy, you’ll have yourself a sixth sense to avoid most of the traps and seize really clear opportunities.

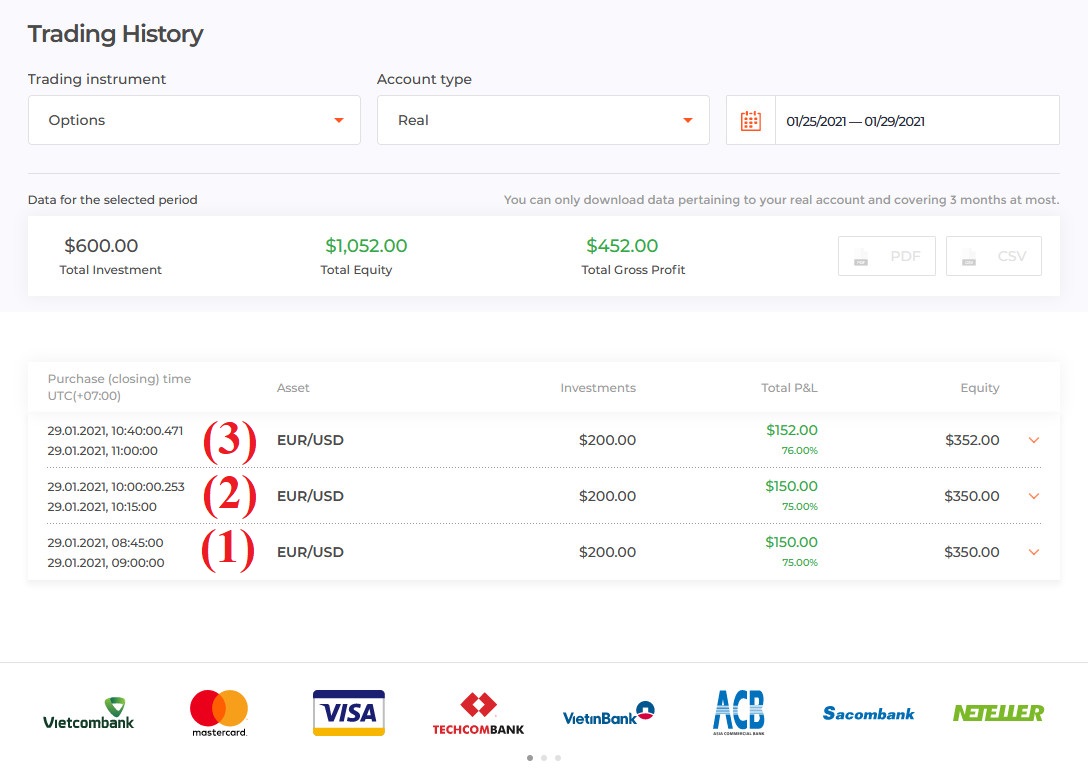

Review opened orders when using T.L.S to trade in IQ Option

- Currency pairs: EUR/USD

- Capital management: Balanced investment of $200 for each order

- Trading strategy: T.L.S (Trend -> Level -> Signal)

At the EUR/USD pair in the Asian session, there was a downtrend. This was the time when you should consider opening only LOWER orders to increase your chances of winning.

1st order: Opened a LOWER order with an expiration time of 15 minutes for $200. The signal was a Doji candlestick which retested the resistance in a downtrend.

2nd order: The downtrend continued and formed an Evening Star candlestick pattern at the resistance zone. This was seen as a signal that the price would continue to decline sharply. Opened a LOWER order with a 15-minute expiration time when the pattern was confirmed.

3rd order: Opened a LOWER order when the signal candle which was a Gravestone Doji candlestick retested the resistance zone with an expiration time of 20 minutes.

Conclusion

The beginning stage will be the tough road in your trading path. And you need to overcome them quickly while continuously learning. Do not stay stuck at the starting line. Go ahead and choose luggage (strategy) to walk with it on the path of financial freedom.

Get rid of those initial myths that make you lose your will and fall. Only then from a beginner can you become a successful few in IQ Option where a lot of people fail.

Enregistrez IQ Option et obtenez 10000$ gratuits Risk warning: Your capital might be at risk.

English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Русский

Русский  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu