English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu

Harmonic pattern strategies are a popular school of trading because of their accuracy every time they appear. It also shows you a new perspective on Price Action. In this article, I will show you how to trade Forex in IQ Option with the Butterfly pattern – a form of the Harmonic pattern.

What is the Butterfly Harmonic pattern?

The Butterfly pattern is a Harmonic price pattern typically seen at the end of an extended price action. It is shaped like the letter M (Bullish Butterfly) or W (Bearish Butterfly) on the chart.

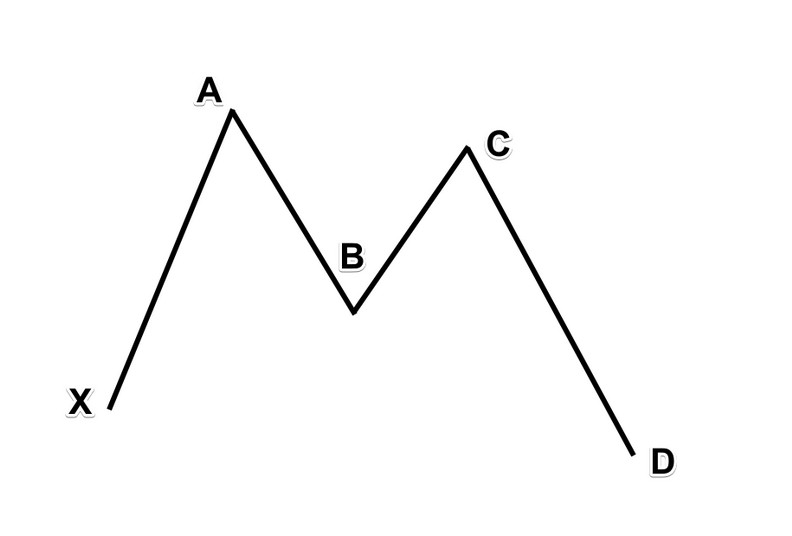

The Butterfly pattern also includes 5 points on the chart and these points are marked with the letters X, A, B, C and D. The point starts at X and goes through 4 swings XA, AB, BC and CD structure as shown below.

The butterfly pattern can sometimes be confused with the Double Top or Double Bottom pattern.

Features of the pattern

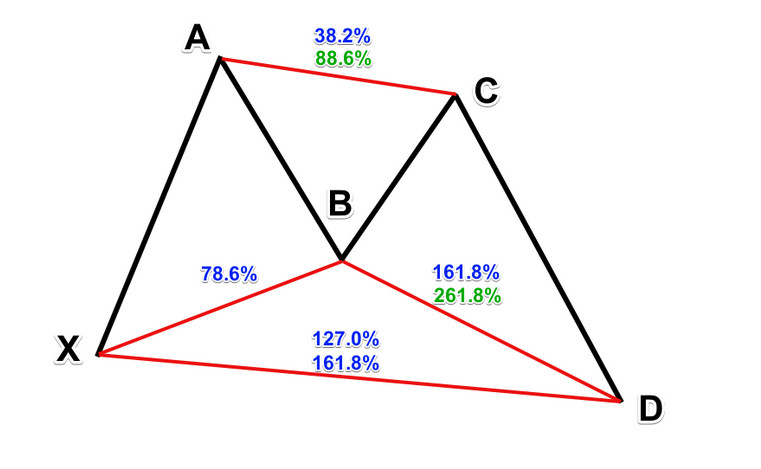

To identify the Butterfly pattern, you will need to confirm that the price action is consistent with the Fibonacci ratios.

- XA: No specific rules are required for this price action.

- AB: Segment AB is a 78.6% correction of segment XA.

- BC: Segment BC is a 38.22% or 88.6% correction of segment AB.

- CD: If BC is a 38.2% correction of AB, then CD will be a 161.8% expansion of BC. On the other hand, if BC is an 88.6% correction of AB, then CD will be a 261.8% extension of BC.

- AD: Finally, the AD segment is a 127.2% or 161.8% extension of XA.

Note: The 78.6% point B correction of the XA is very important. It is the first condition used to distinguish the Butterfly pattern from other Harmonic patterns.

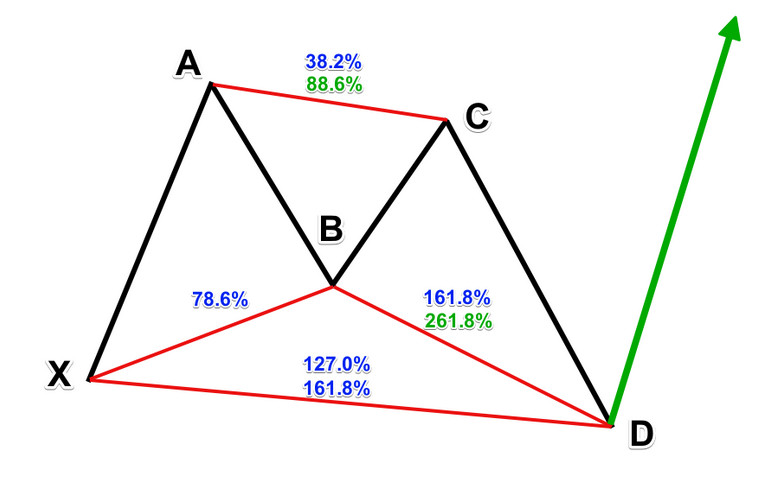

Bullish Butterfly pattern

The Bullish Butterfly pattern starts with a bullish span XA — then the AB span declines – the BC span rises and finally a falling CD span once again exceeds the X bottom. Following this move combined with the corresponding proportions. with the Fibonacci levels according to the above rule, we predict the market will have an uptrend from point D.

The Bullish Butterfly pattern’s shape is like the letter M.

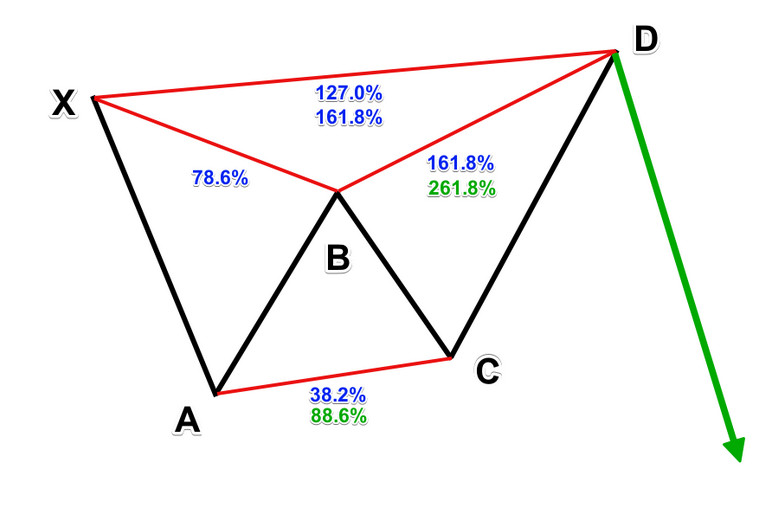

Bearish Butterfly pattern

The Bearish Butterfly pattern is completely similar to the Bullish Butterfly pattern but reversed. It starts with a bearish XA span, followed by a bullish AB span, a BC drop and finally a CD rally again. Follow this move in conjunction with the ratio corresponding to the Fibonacci levels according to the above rule, we expect the market to have a downtrend from point D.

The Bearish Butterfly pattern’s shape is like the letter W.

How to trade Forex with the Butterfly Harmonic pattern

To enter a trade with the Butterfly pattern, you first need to identify it according to the rules above. For easy tracking, you should mark the important points X, A, B, C, D on your chart. Then check the markers with the Fibonacci tool to make sure the pattern is correct.

Open a BUY order at point D if the pattern is the Bullish Butterfly. You should place the stop loss below the entry point. Take profit will be the nearest top of the Butterfly Harmonic pattern.

Open a SELL order at point D if the pattern is a bearish butterfly. You should place an automatic stop loss above the appropriate entry point. Take Profit will be the nearest bottom of the Butterfly pattern.

Depending on the market conditions, you will have different ways to take profits. It is more effective to use Fibonacci in combination with some other technical tools.

Summary

The Butterfly Harmonic pattern offers the opportunity to trade right from the beginning of a new trend so traders can make more profits with less risk. The most important thing of this strategy is in the pattern identification stage. Therefore, you need to practice recognizing price patterns on a demo account before participating in making money from the Forex market in IQ Option.

English

English  Indonesia

Indonesia  Português

Português  Tiếng Việt

Tiếng Việt  ไทย

ไทย  العربية

العربية  हिन्दी

हिन्दी  简体中文

简体中文  Nederlands

Nederlands  Français

Français  Deutsch

Deutsch  हिन्दी

हिन्दी  Italiano

Italiano  한국어

한국어  Melayu

Melayu  Norsk bokmål

Norsk bokmål  Español

Español  Svenska

Svenska  Tamil

Tamil  Türkçe

Türkçe  Zulu

Zulu